Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Monday Dec 1 2025 09:01

9 min

Trading tools for beginners: In the realm of trading and technical analysis, various tools help traders make informed decisions.

Learn to trade: One such powerful analytical instrument is the Fibonacci retracement tool. This article serves as a comprehensive guide to understanding the Fibonacci retracement tool, detailing its purpose, how to use it, its significance, and strategies for effectively integrating it into trading.

The Fibonacci sequence is a mathematical sequence named after the Italian mathematician Leonardo of Pisa, known as Fibonacci. The sequence starts with 0 and 1, with each subsequent number being the sum of the two preceding ones. This sequence manifests in various natural phenomena and has been adopted in fields ranging from art to finance.

In trading, Fibonacci numbers are used to identify potential retracement levels in the price movements of stocks and other financial instruments. Traders use these levels to predict areas of price reversals based on historical behavior.

The Fibonacci retracement tool is a technical analysis tool that utilizes the Fibonacci sequence to identify potential reversal levels in asset prices. It helps traders estimate where an asset might retrace before continuing in the direction of the trend.

When a price trend is established, either upwards or downwards, the Fibonacci tool calculates horizontal lines at key Fibonacci levels, typically at 23.6%, 38.2%, 50%, 61.8%, and 100%. These levels indicate potential areas of support or resistance where the price could reverse or consolidate.

3.1 Step-by-Step Guide to Setting Up the Tool

Identify a Significant Price Movement:

Start with a clear trend in either direction. For uptrends, identify a swing low to a swing high. For downtrends, identify a swing high to a swing low.

Select the Fibonacci Tool:

Most trading platforms feature a Fibonacci retracement tool in their charting software.

Plot the Levels:

For an uptrend, click on the swing low and drag to the swing high. For a downtrend, do the opposite. The tool will automatically plot the key Fibonacci levels between these points.

Analyze the Levels:

Observe where these levels align with previous support or resistance areas to confirm their significance.

3.2 Identifying Key Levels

Once the Fibonacci levels are plotted, observe how the price reacts as it approaches these levels. Traders typically look for:

Price Reactions: A bounce or reversal at one of the Fibonacci levels may indicate it is a significant support or resistance area.

Confluence with Other Indicators: When Fibonacci levels coincide with other technical indicators or chart patterns, they may carry even more weight in predictions.

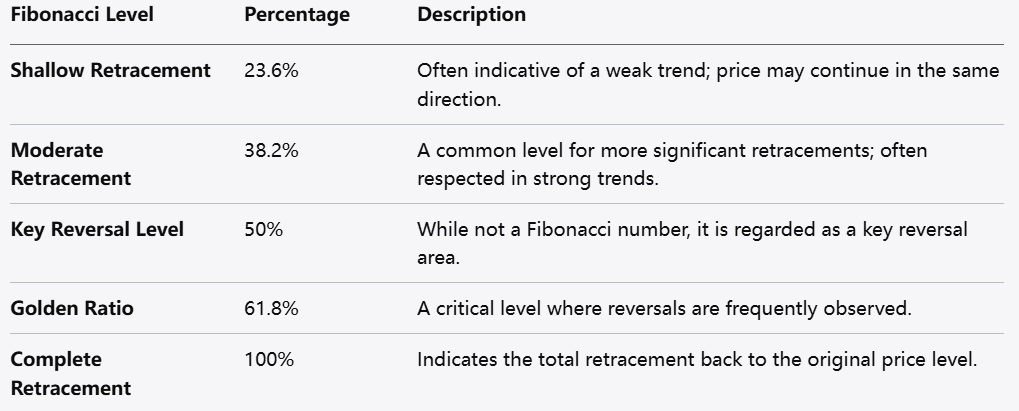

4.1 Key Retracement Levels

The most commonly used Fibonacci levels in retracement analysis are:

23.6%: A shallow retracement; often indicative of a weak trend.

38.2%: A common level for more significant retracements, often respected in strong trends.

50%: While not a Fibonacci number, this level is widely regarded by traders as a key reversal level.

61.8%: Known as the "golden ratio," it is a critical level where reversal is often seen.

100%: Indicates the complete retracement back to the original volume.

4.2 Extension Levels

In addition to retracement levels, Fibonacci extensions (such as 161.8%, 261.8%, etc.) help estimate potential areas where prices could move after a retracement. These levels are derived by applying the Fibonacci ratios to the previous price movement after the retracement has occurred.

Traders utilize the Fibonacci retracement tool in various scenarios, including:

Swing Trading: Identifying entry points in trending markets.

Day Trading: Finding short-term reversal points.

Long-term Investing: Assessing potential buy and sell levels in longer price trends.

By analyzing historical price action, traders can better predict future movements, making informed decisions based on retracement levels.

For increased accuracy, traders often pair Fibonacci retracement with other technical analysis tools.

6.1 Moving Averages

Moving averages can be used to confirm Fibonacci levels. For example, if a Fibonacci level coincides with a moving average, it might indicate a stronger support or resistance level.

6.2 Trend Lines

Combining Fibonacci levels with trend lines can help identify breakout points. When a retracement approaches both a Fibonacci level and a trend line, it may signal a high-probability trading opportunity.

6.3 Candlestick Patterns

Observing candlestick patterns around Fibonacci levels can provide additional confirmation. For example, a bullish engulfing pattern at the 61.8% retracement level may indicate a strong potential reversal.

While the Fibonacci retracement tool can be powerful, traders often make mistakes that hinder effectiveness:

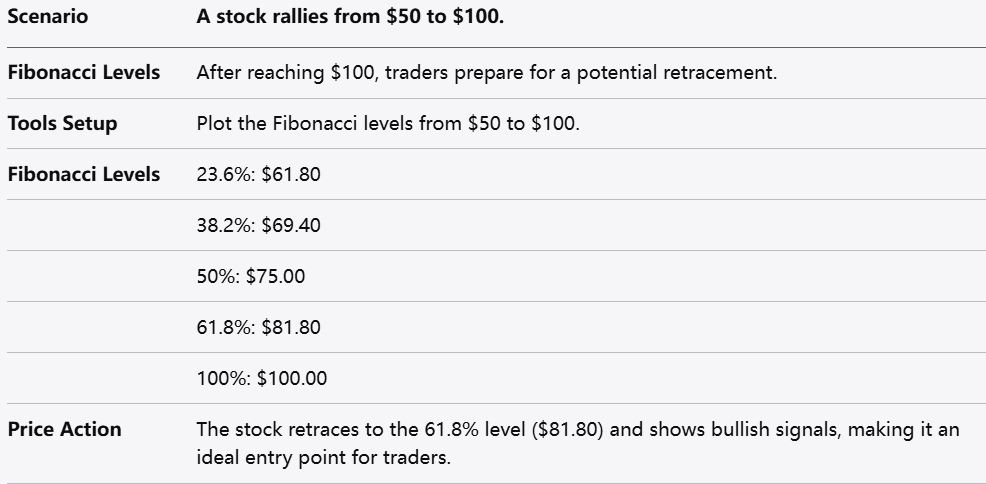

8.1 Example 1: Bull Market

Scenario: A stock rallies from $50 to $100.

Fibonacci Levels: After reaching $100, traders prepare for a potential retracement.

Tools Setup: Plot the Fibonacci levels from $50 to $100.

Price Action: The stock retraces to the 61.8% level ($81.80) and shows bullish signals, making it an ideal entry point for traders.

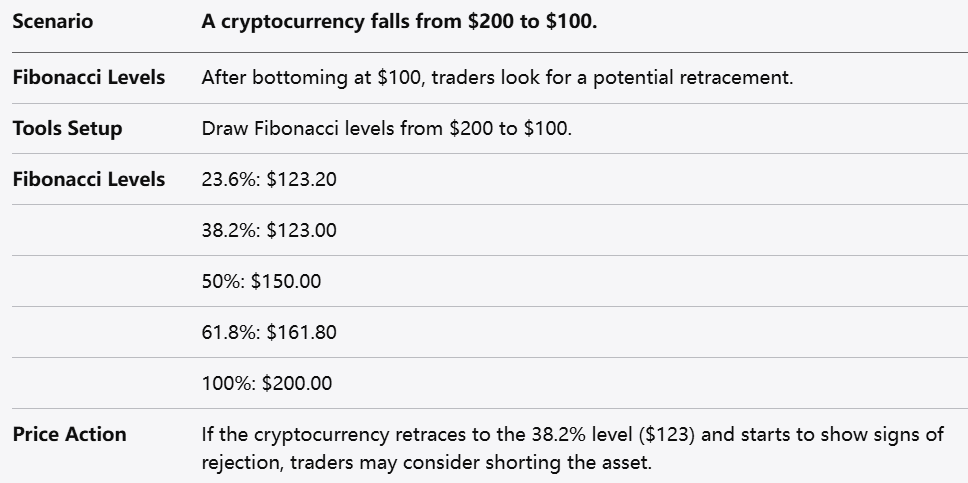

8.2 Example 2: Bear Market

Scenario: A cryptocurrency falls from $200 to $100.

Fibonacci Levels: After bottoming at $100, traders look for a potential retracement.

Tools Setup: Draw Fibonacci levels from $200 to $100.

Price Action: If the cryptocurrency retraces to the 38.2% level ($123) and starts to show signs of rejection, traders may consider shorting the asset.

The Fibonacci retracement tool is a valuable asset for traders seeking to better understand market movements and predict potential reversals. By mastering this tool, alongside other technical indicators and proper risk management practices, traders can enhance their decision-making process.

As with any trading strategy, practice, and ongoing learning are essential for leveraging the Fibonacci retracement tool effectively. By applying the knowledge gained from this article, traders can move toward more successful outcomes in their trading endeavors.

Looking to trade CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.