Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Monday Dec 1 2025 07:47

13 min

Learn to trade: Earnings season is the period during which publicly traded companies release their quarterly earnings reports.

CFD trading guide: This typically occurs after the end of a financial quarter and can span several weeks, as different companies announce their results on different dates.

During this timeframe, investors and traders eagerly anticipate the performance metrics that companies will disclose, including earnings per share (EPS), revenue figures, and future guidance.

Earnings reports are crucial for determining a company's financial health and can significantly influence stock prices. A strong earnings report can boost a stock's price, while a disappointing one can lead to a sell-off. For traders, this presents both opportunities and risks.

Consider a technology company that consistently beats earnings expectations based on market forecasts. If the company's report exceeds analyst estimates, the stock may rally significantly. Conversely, if the company’s earnings fall short of expectations, even if the company is still profitable, the stock may decline sharply, reflecting market disappointment.

Expectations Around Earnings Season

Traders often gauge market sentiment leading up to earnings season by analyzing consensus estimates established by financial analysts. These estimates serve as benchmarks, shaping expectations. Companies might offer guidance on future earnings, giving traders insights into potential performance.

Trading Before an Announcement

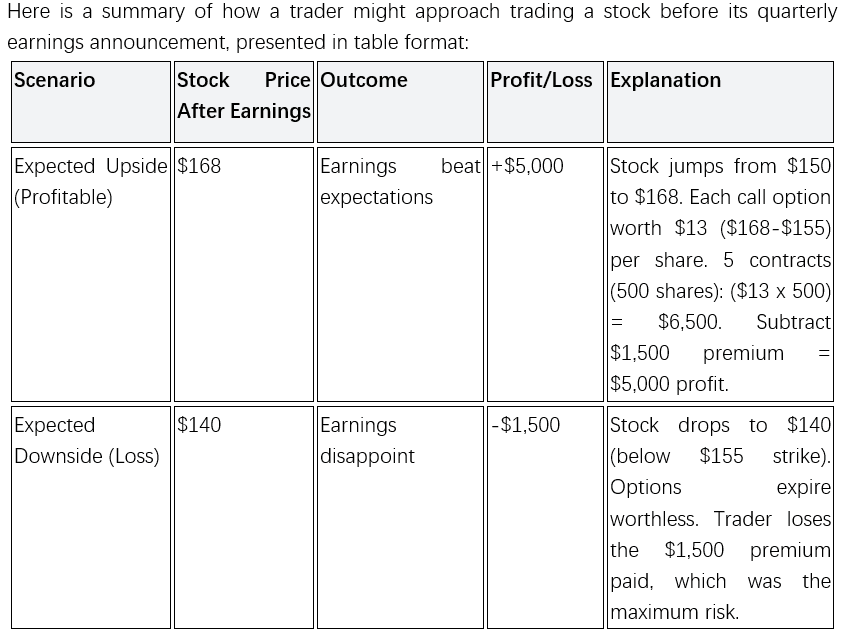

Many traders choose to engage in pre-earnings trading, where they buy or sell stocks based on their expectations. This strategy can lead to considerable rewards but also substantial risks.

Example

Imagine a retail company that typically sees high sales during the holiday season. If analysts predict strong earnings based on sales data, many traders may choose to buy shares in anticipation of a positive announcement. If the actual earnings exceed expectations, this strategy can yield significant returns. Conversely, if the earnings turn out to be lower than expected, those who bought in advance may face losses.

Understanding how to interpret a company’s earnings report is essential for making informed trading decisions. Here are several core metrics to focus on:

Core Metrics

Earnings Per Share (EPS): This is the net income divided by the number of outstanding shares. A higher EPS typically signals a more profitable company.

Revenue: This indicates the total income generated from sales. Growth in revenue over time can signal a healthy, expanding business.

Net Income: This represents the profit after all expenses have been deducted. It's a crucial indicator of a company's overall profitability.

Margins

Analyzing profit margins, including gross and operating margins, can offer insights into profitability relative to sales.

Gross Margin: This is calculated by subtracting the cost of goods sold from total revenue, then dividing by total revenue. A high gross margin indicates efficient production and pricing strategies.

Operating Margin: This is calculated by dividing operating income by revenue. It measures operational efficiency, excluding costs directly tied to the production process.

Forward Guidance

Companies often provide forward guidance during their earnings announcements, offering estimates about expected future performance. Traders should pay close attention to this guidance, as it can significantly influence stock prices.

Free Cash Flow (FCF)

Free cash flow is a critical metric that measures the cash a company generates after accounting for capital expenditures. A positive free cash flow indicates that a company has enough cash to meet obligations, reinvest in the business, or return capital to shareholders.

Debt Metrics

Analyzing a company's debt levels is vital in assessing financial health.

Debt-to-Equity Ratio: This ratio compares a company’s total liabilities to its stockholders’ equity. A high ratio may indicate potential risk, especially in uncertain economic conditions.

Interest Coverage Ratio: This measures a company's ability to pay interest on its debt. A higher ratio suggests a greater ability to service debt.

There are multiple strategies for trading based on earnings announcements, including investing in stocks, options trading, and contracts for difference (CFDs).

Investing in the Stock

Buying or selling shares based on anticipated earnings can yield significant results. However, this strategy requires careful consideration of potential risks and market reactions.

Options Trading

Options are financial derivatives that allow traders to buy or sell an asset at a predetermined price within a specific timeframe. Before earnings reports, traders can utilize options strategies to hedge their bets or speculate on price movements.

Buying Calls/Puts: If a trader believes a stock will rise post-announcement, they may buy call options. If they predict a decline, put options can be purchased.

Straddles: This strategy involves buying both call and put options to capitalize on volatility, regardless of the direction of the price movement.

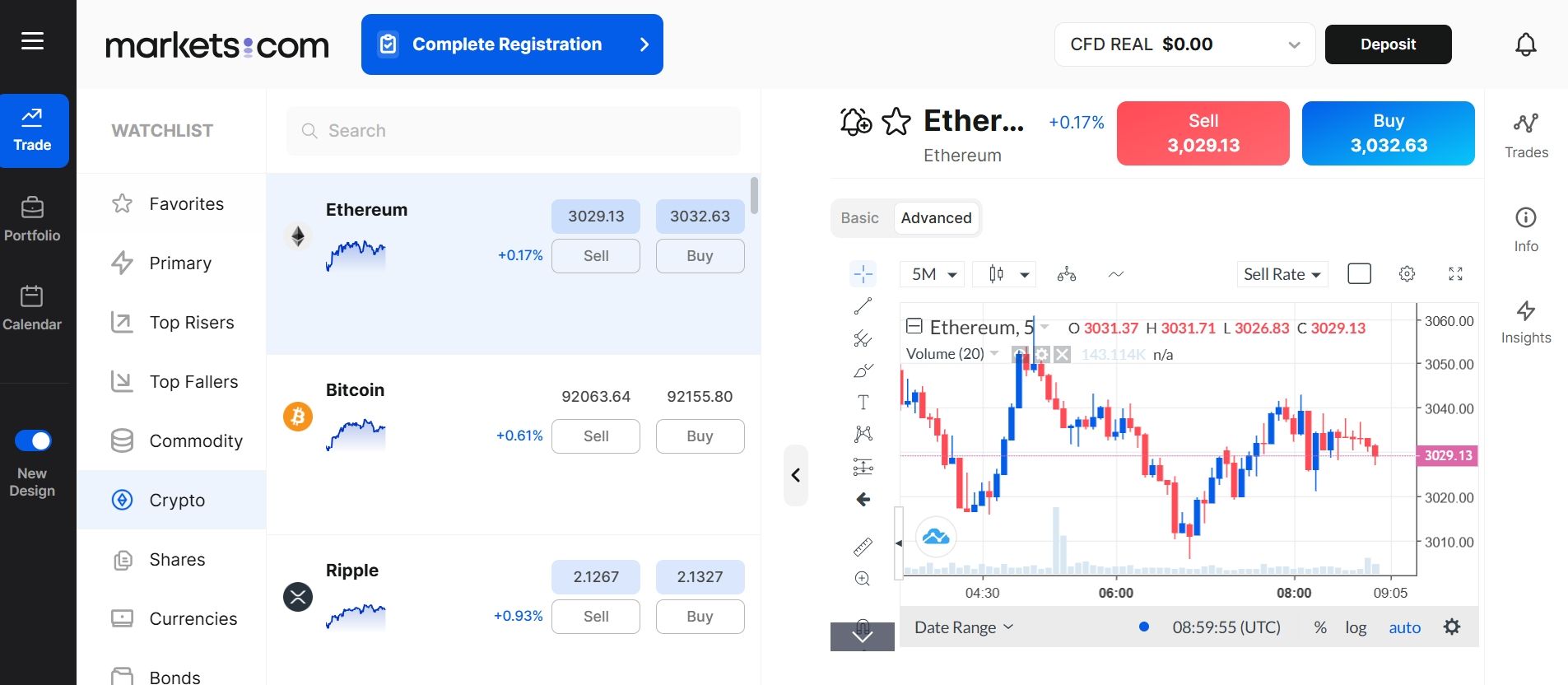

Contracts for Difference (CFDs)

CFDs enable traders to speculate on price movements without owning the underlying asset. Traders can go long (buy) if they anticipate a price increase, or short (sell) if they expect a decrease.

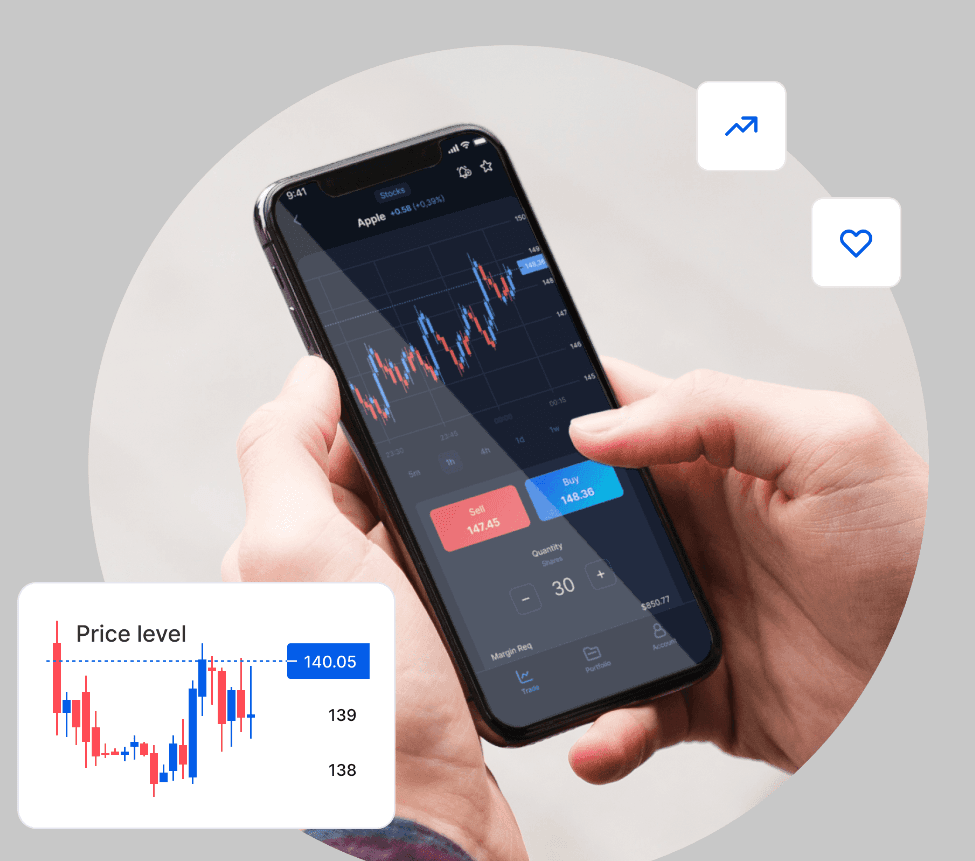

Markets.com offers a user-friendly platform for trading various assets, including stocks, commodities, and currencies. Traders can leverage CFDs to gain exposure to price movements without the need for significant capital.

User-Friendly Interface

One of the standout features of Markets.com is its intuitive and accessible interface. The platform is designed to cater to traders of all experience levels, ensuring that new users can easily navigate its features while providing advanced tools for seasoned professionals. The seamless layout enables quick access to essential functions, making it easier to execute trades swiftly in fast-moving markets.

Wide Range of Tradable Assets

Markets.com offers an extensive selection of assets, allowing traders to diversify their portfolios effectively. The platform includes:

Stocks: Trade shares of major companies from various global markets without needing physical ownership.

Commodities: Engage in trading popular commodities such as gold, silver, oil, and agricultural products.

Forex: Take advantage of currency movements in the forex market with a vast array of currency pairs.

Indices: Access major global indices, providing exposure to an entire sector or economy.

This diversity enables traders to capitalize on different market trends, reducing risk exposure associated with investing in a single asset class.

Leverage and Capital Efficiency

CFDs allow traders to use leverage, meaning they can open larger positions with a smaller initial investment. Markets.com offers competitive leverage options, which can amplify potential gains without requiring significant capital upfront. For instance, with a leverage ratio of 1:10, a trader can control a $10,000 position with only $1,000. While leverage enhances profit potential, it’s vital to be aware of the associated risks, as losses can also be magnified.

Risk Management Tools

Effective risk management is crucial for successful trading, and Markets.com provides several built-in features to help traders manage their risk exposure:

Educational Resources

Markets.com recognizes the importance of education in fostering successful trading habits. The platform offers a variety of educational resources, including webinars, tutorials, and market analysis.

These materials are essential for traders looking to enhance their knowledge of the markets and build effective trading strategies. For beginners, this educational support is invaluable in building confidence and competence in trading.

Responsive Customer Support

Traders can benefit from responsive customer support at Markets.com, which is available via multiple channels, including live chat, email, and phone. The support team is knowledgeable and can assist with inquiries ranging from technical issues to trading strategies, ensuring that users can navigate the platform and the markets confidently.

Mobile Trading

In today’s fast-paced world, the ability to trade on the go is crucial. Markets.com offers a mobile app that allows traders to manage their accounts, execute trades, and access market news and analysis from their smartphones or tablets. This mobile capability ensures that traders can stay connected and make timely decisions, regardless of their location.

Risk management is critical during earnings season due to the heightened volatility surrounding earnings announcements. Here are some strategies to consider:

Historical performance can shape expectations dramatically. If a company consistently beats earnings estimates each quarter, traders may build greater confidence, resulting in more substantial price movements upon expected announcements. Conversely, if a company's results frequently miss forecasts, traders might react more negatively to future reports, leading to sharper declines even if trends appear stable.

Earnings season presents unique opportunities for traders willing to navigate the challenges of volatility and market sentiment. By understanding the importance of earnings reports, analyzing core metrics, and employing strategic trading methods, traders can capitalize on the potential moves in stock prices.

Effective risk management and a solid grasp of historical context can further refine trading strategies. While the uncertainty of earnings season can be daunting, it also offers exciting opportunities for those prepared to engage with the market's ebbs and flows. By adopting a well-researched approach, traders can enhance their understanding and execution during this critical period.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.