Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Wednesday Nov 19 2025 09:19

17 min

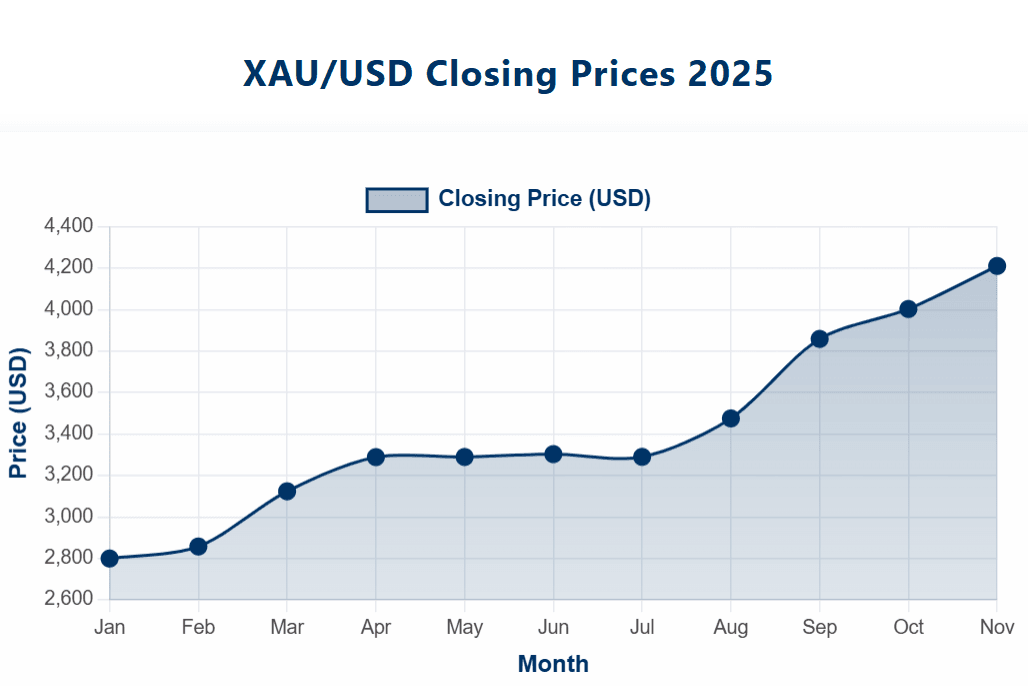

XAU/USD price today: Gold has been an essential asset throughout human history, revered for its physical qualities, rarity, and enduring value.

In modern financial markets, gold is a key commodity, often traded against the US Dollar under the ticker XAU/USD. Understanding the factors that influence gold prices, the interplay between gold and the dollar, and the benefits of trading gold can provide valuable insights for market participants.

This article explores the current dynamics of gold trading, the benefits it offers, the main factors influencing its price, and how the US Dollar interacts with gold to shape market outcomes.

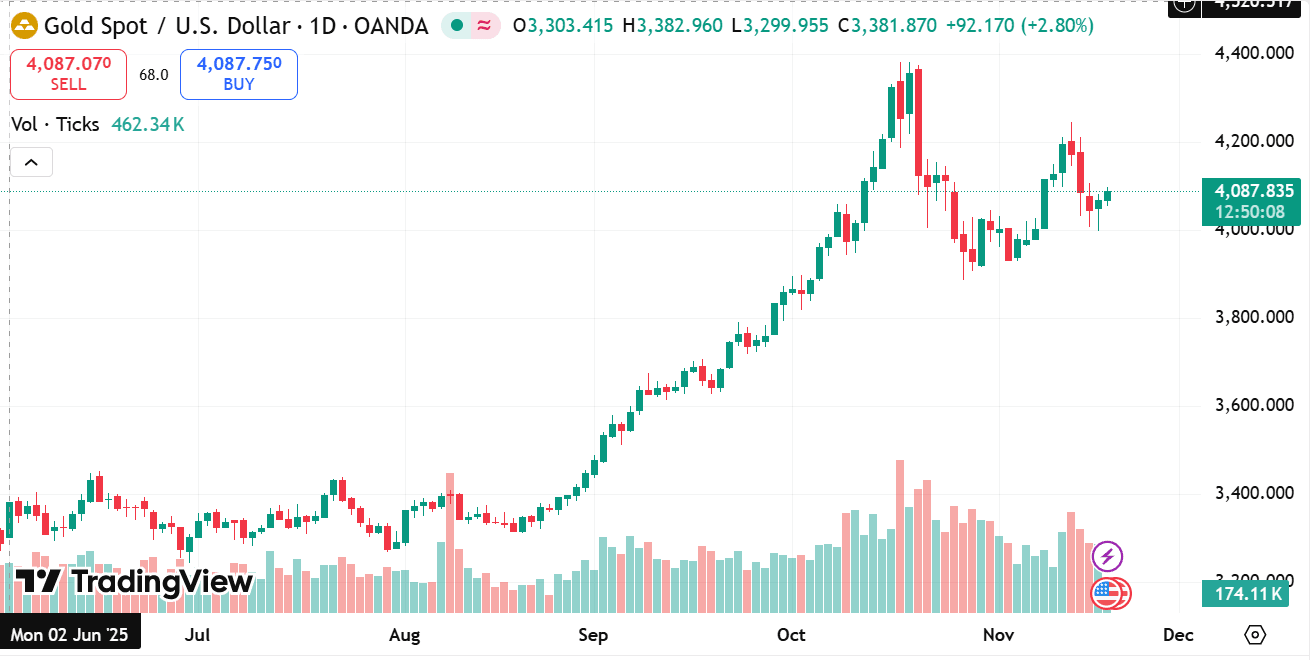

source: tradingview

Before diving into the complexities of gold trading, it is important to clarify what XAU/USD represents. XAU is the symbol for one troy ounce of gold, and USD stands for the United States Dollar. The XAU/USD pair reflects the price of gold quoted in US Dollars, serving as a global benchmark for gold valuation.

Trading XAU/USD means speculating on or investing in the value of gold relative to the dollar. Because gold is priced globally in USD, fluctuations in the dollar’s strength directly affect the perceived value of gold, making this pair one of the most closely watched in financial markets.

1. Portfolio Diversification

One of the most significant advantages of gold trading is its ability to diversify investment portfolios. Gold often behaves differently from stocks, bonds, and other financial instruments, offering a hedge against market volatility. When equities or currencies decline, gold frequently holds value or even appreciates, providing balance and reducing overall portfolio risk.

2. Hedge Against Inflation and Currency Depreciation

Gold has a long reputation as a store of value during periods of inflation or when currencies lose purchasing power. As central banks implement monetary policies that may lead to inflation, traders often turn to gold to preserve wealth. This defensive characteristic makes gold a valuable asset in uncertain economic environments.

3. High Liquidity and Accessibility

The gold market is highly liquid, with continuous trading worldwide through exchanges, over-the-counter markets, and futures contracts. This liquidity enables traders to enter and exit positions quickly without significant price impact. Additionally, advances in technology have made gold trading accessible to retail traders via online platforms.

4. Safe Asset in Times of Uncertainty

Political instability, economic crises, or geopolitical tensions tend to increase demand for gold. This “flight to safety” phenomenon arises because gold is a tangible asset that has historically maintained value across diverse scenarios. While the term “safe haven” is widely used, it is important to understand that gold’s resilience makes it a preferred asset during turbulence.

5. Potential for Profit in Both Rising and Falling Markets

Gold trading allows participation in both upward and downward price movements through various instruments such as futures, options, and CFDs. Traders can take long or short positions, potentially profiting regardless of market direction, provided they correctly anticipate price trends.

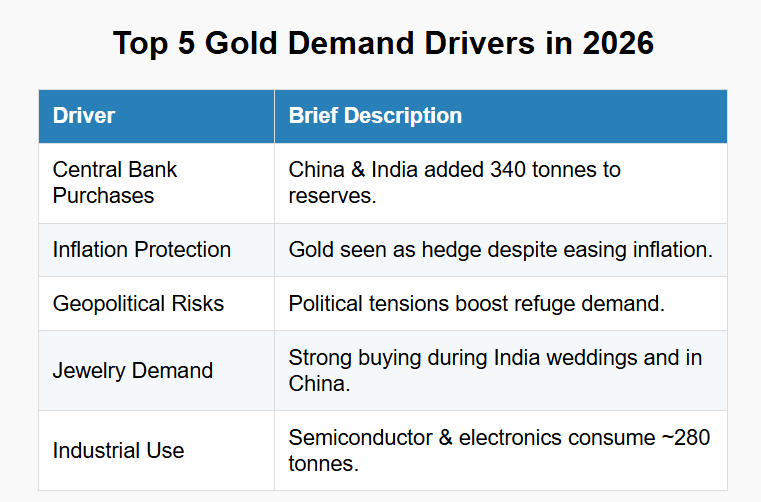

Gold prices are influenced by a complex set of factors, which can be broadly categorized into economic, geopolitical, demand-supply, and market sentiment drivers.

Economic Factors

Natural disasters, pandemics, and political upheavals can also create volatility in financial markets, with gold serving as a perceived protective asset.

Demand and Supply Dynamics

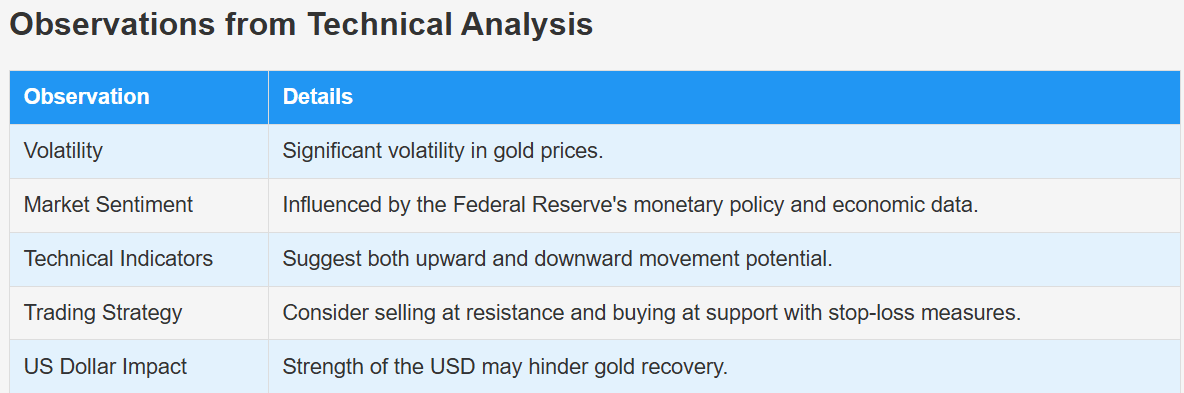

The relationship between the US Dollar and gold is central to understanding gold price movements. Since gold is denominated in dollars, the currency’s fluctuations exert considerable influence on the precious metal’s valuation.

Dollar Strength and Gold Price Inverse Correlation

Historically, gold prices often move inversely to the dollar’s strength. When the dollar appreciates against other currencies, gold tends to decline because it becomes more expensive in foreign currency terms, reducing international demand.

Conversely, when the dollar weakens, gold becomes cheaper for holders of other currencies, increasing demand and pushing prices higher.

Several factors influence the dollar’s value, including:

Changes in any of these can cause shifts in the dollar’s strength, thereby impacting gold prices indirectly.

How the Dollar Influences Gold: Decoding USD Trends

Understanding the nuances of dollar trends helps clarify their impact on gold.

Interest Rate Expectations

Expectations of rising interest rates tend to strengthen the dollar as higher yields attract capital. This dynamic can pressure gold prices downward. Conversely, expectations of rate cuts or prolonged low rates usually weaken the dollar, benefiting gold.

Inflation Outlook

If inflation is expected to rise but interest rates remain low, gold often gains appeal. This situation usually coincides with a weaker dollar scenario, reinforcing upward pressure on gold.

Monetary Policy Announcements

Federal Reserve communications and policy decisions are closely watched for indications of future dollar strength or weakness. Unexpected policy moves can cause sharp fluctuations in both the dollar and gold.

The Connection Between USD and Gold Prices

The gold market is driven by the complex interaction of USD dynamics, economic indicators, and investor behavior.

Currency Hedging and Safe Asset Demand

Some market participants use gold as a hedge against dollar depreciation and currency risks. During times of dollar instability, demand for gold as an alternative store of value typically rises.

Capital Flows and Global Liquidity

US dollar liquidity in global markets affects gold demand. When liquidity is abundant, risk-taking increases, potentially reducing gold demand. When liquidity tightens, gold often benefits as a liquid and accessible asset.

The US Dollar's role as the world’s reserve currency means its fluctuations resonate widely. Central banks, multinational corporations, and governments all hold and trade dollars, influencing global financial stability.

Central Bank Gold Reserves

Central banks’ management of gold reserves can reflect confidence in the dollar and the global monetary system. Changes in gold reserve holdings can signal shifts in sentiment and influence market perceptions.

International Trade and Dollar Usage

Global trade invoiced in dollars links the currency closely to economic activity. Shifts in trade balances and dollar demand for commerce can indirectly affect gold through currency strength fluctuations.

USD and Gold: Navigating Their Market Relationship

Navigating the intertwined nature of the dollar and gold prices requires attention to multiple market signals.

Monitoring Economic Data

Indicators such as employment figures, inflation rates, GDP growth, and consumer spending provide clues about dollar strength and gold demand.

Tracking Monetary Policy Signals

Statements from Federal Reserve officials, policy meeting minutes, and economic forecasts play a pivotal role in shaping expectations.

Observing Geopolitical Developments

Global tensions and crises can rapidly shift demand between the dollar and gold, underscoring their roles as competing stores of value.

The Dynamics of the Dollar and Its Effect on Gold Pricing

The dollar’s fluctuations create a dynamic environment for gold pricing, influenced by:

These factors create continuous shifts, making gold a reactive and sometimes leading indicator of broader market trends.

Understanding the underlying tactics for trading gold is crucial for maximizing opportunities. Below are several trading tactics that can enhance one’s effectiveness in the gold market.

1. Technical Analysis Techniques

A. Support and Resistance Levels

Understanding support and resistance levels is fundamental in trading gold.

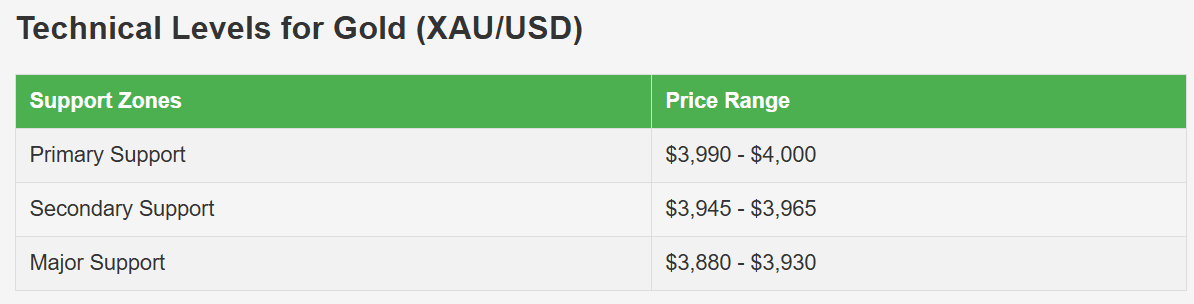

Support Levels: When prices approach a support level, they often bounce back, making it a strategic point to enter a long position. For example, if gold prices are approaching a primary support level (like $3,990 - $4,000), traders might look to buy as prices near this level, anticipating a price rebound.

Resistance Levels: Conversely, resistance levels (such as $4,070 - $4,075) act as ceilings where prices often reverse. Traders might look to sell or short at these levels, expecting prices to decline.

By utilizing technical charts to identify these levels, traders can make informed decisions on entry and exit points.

B. Chart Patterns

Identifying chart patterns, such as head and shoulders, double tops, or triangles, can provide insights into potential price movements. For example:

A double bottom chart pattern at a support level could signal a bullish reversal, suggesting an opportunity to go long.

A head and shoulders pattern forming at a resistance level may indicate a bearish trend reversal, signaling an opportunity to short the asset.

C. Moving Averages

Using moving averages can help smooth out price action and identify trends. Traders might consider:

The 50-day moving average (MA): When prices are consistently above this level, it suggests a bullish trend and may indicate buying opportunities.

The 200-day MA: Often viewed as a significant long-term trend indicator. Prices crossing above this level may signal a prolonged bullish move.

Traders often employ crossover strategies, analyzing when a shorter-term MA crosses above or below a longer-term MA to execute trades.

2. Fundamental Analysis Tactics

A. Economic Indicators

Gold prices are heavily influenced by various economic indicators. Staying informed about such indicators can lead to strategic decisions:

Inflation Rates: Higher inflation typically drives gold prices up as investors flock to gold to preserve value.

Interest Rates: Given that gold does not yield interest, rising interest rates can lead to declines in gold price as investors turn to interest-bearing assets. Keeping an eye on Federal Reserve announcements regarding monetary policy is crucial.

B. Geopolitical Events

Uncertainty arising from geopolitical events drives gold demand. Traders should:

Monitor global tensions, elections, and conflicts. As uncertainties rise, gold is likely to experience increased buying.

Consider shifts in major economies, particularly the U.S. and China, as their economic health significantly influences gold prices.

3. Sentiment Analysis

Understanding market sentiment is essential in gold trading. Tools and tactics include:

A. Commitment of Traders (COT) Report

The COT report provides insights into trader positions in the futures market, revealing whether large traders are bullish or bearish. An increase in long positions from commercial traders indicates growing confidence, suggesting a potential price rise. Conversely, excessive short positions might indicate an impending correction.

B. Sentiment Indicators

Utilizing sentiment indicators, such as the Fear & Greed Index, can aid in gauging market psychology. High levels of greed may indicate overbought conditions, suggesting it may be time to sell, while fear can indicate potential buying opportunities.

4. Risk Management Strategies

Effective risk management is the backbone of successful trading:

A. Position Sizing

Calculating an appropriate position size is fundamental. Traders often utilize the "2% rule," which suggests risking no more than 2% of the account on a single trade. This ensures that no single loss severely impacts their trading capital.

B. Stop-Loss Orders

Implementing stop-loss orders is vital for protecting against adverse price movements.

For a long position, a stop-loss might be placed just below a significant support level.

For a short position, it could be set just above a key resistance level.

5. Trading Strategies

A. Trend Following Strategy

This involves identifying the prevailing trend and trading in its direction.

Bullish Trends: Look for buying opportunities on dips within the uptrend, using support levels to guide entries.

Bearish Trends: Sell on rallies within the downtrend, focusing on resistance levels.

B. Range Trading

In sideways markets, traders may capitalize on price fluctuations between established support and resistance levels, buying near support and selling near resistance.

C. News-Based Trading

Trading based on economic news releases can yield quick profits or losses.

Be prepared to enter positions just before major announcements (like interest rate decisions) and reap the rewards of sudden volatility.

Gold trading remains a compelling activity due to the metal’s unique attributes and its close relationship with the US Dollar. Understanding the benefits of trading gold, the multifaceted factors impacting its price, and the complex interplay with the dollar is essential for any market participant.

Gold’s enduring appeal as a portfolio diversifier, inflation hedge, and store of value continues to be relevant in today’s global financial environment. The ongoing movements in the US Dollar will remain a critical driver of gold prices, making their relationship a central focus for traders, investors, and observers alike.

By studying these dynamics, one can better navigate the gold market and anticipate future price trends with greater confidence.

Looking to trade gold (XAU/USD) CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.