Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Tuesday Nov 25 2025 09:52

14 min

What is SPDR S&P 500 ETF: As one of the oldest, largest, and most traded exchange-traded funds (ETFs) in the world, SPY holds a unique place in the portfolios of individuals and institutions alike.

This article provides a comprehensive exploration of SPY, from its fundamental structure to its practical applications and inherent considerations.

Before diving into the specifics of SPY, it is crucial to understand the vehicle through which it operates: the exchange-traded fund. An ETF is a type of investment fund that is pooled and managed, much like a mutual fund. It holds a collection of assets, such as stocks, bonds, or commodities. The key difference is that shares of an ETF are listed on a stock exchange and can be bought and sold throughout the trading day, just like an individual stock.

This structure combines the diversification benefits of a mutual fund with the liquidity and trading flexibility of a stock. Instead of buying hundreds of individual stocks to replicate an index, a market participant can purchase a single share of an ETF and gain exposure to all of them. This simplicity and efficiency have made ETFs incredibly popular.

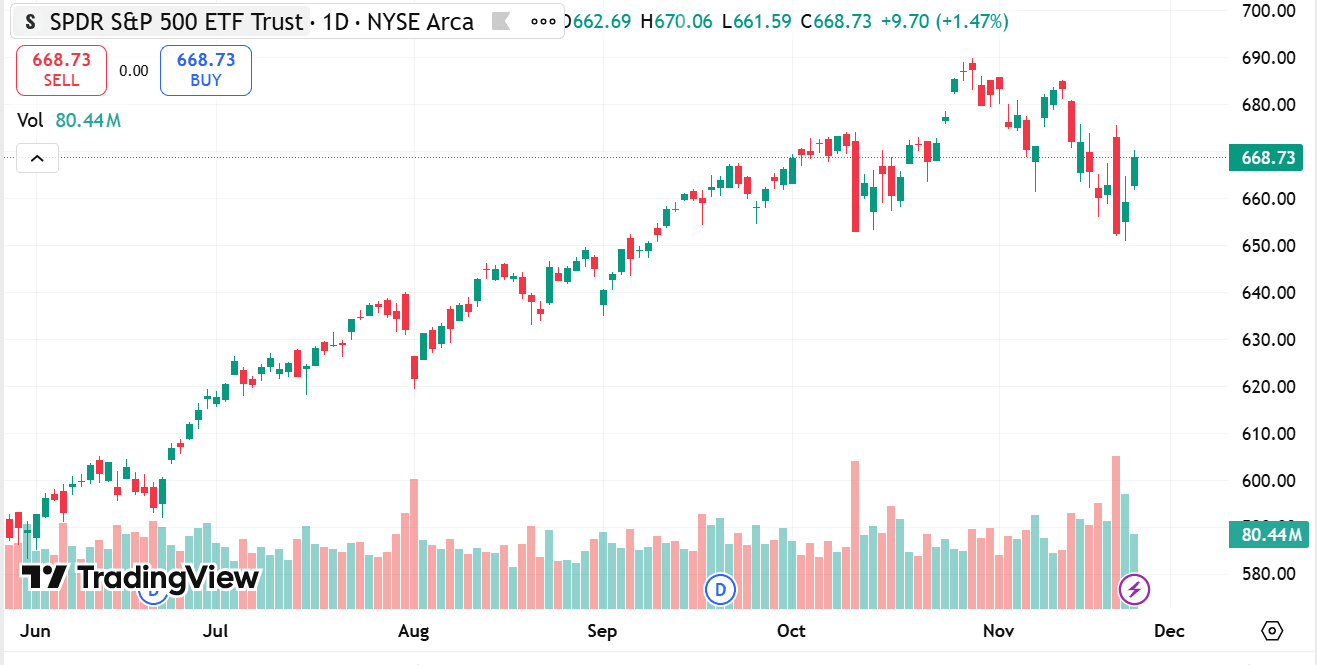

source: tradingview

The SPDR S&P 500 ETF, commonly known by its ticker SPY, is an ETF designed to track the performance of the Standard & Poor's 500 Index (S&P 500). The S&P 500 is a stock market index that represents the performance of 500 of the largest publicly traded companies in the United States. These companies are selected by a committee based on criteria such as market size, liquidity, and sector representation. As a result, the S&P 500 is widely regarded as one of the best gauges of large-cap U.S. equities and a barometer for the overall health of the U.S. stock market and economy.

When you purchase a share of SPY, you are buying a small piece of a portfolio that holds the stocks of all 500 companies in the index. The fund's objective is to replicate the price and yield performance of the S&P 500 as closely as possible, before expenses. It achieves this by holding the component stocks of the index in approximately the same weights as they have in the index itself. This strategy is known as passive management, as the fund manager is not actively picking stocks but rather mirroring an existing benchmark.

Launched in January 1993, SPY was the very first ETF listed in the United States. Its creation democratized market access, allowing anyone with a brokerage account to invest in the broad U.S. stock market with a single transaction.

The operational mechanism behind SPY is a sophisticated process involving a fund sponsor, authorized participants (APs), and the stock market itself.

1. The Fund Structure:

SPY is structured as a unit investment trust (UIT).

This is a unique and somewhat rigid structure compared to more modern ETFs. As a UIT, SPY is legally obligated to fully replicate its underlying index. It must hold every stock in the S&P 500. It also cannot reinvest dividends directly back into the fund. Instead, it holds them as cash and distributes them to shareholders on a quarterly basis. This is a subtle but important distinction from many other ETFs that are structured as open-ended funds and can reinvest dividends automatically.

2. Creation and Redemption:

The number of SPY shares in circulation is not fixed.

It expands and contracts based on demand through a creation and redemption process facilitated by authorized participants, which are typically large financial institutions or market makers.

Creation: If there is high demand for SPY shares in the market, causing its price to trade at a premium to the net asset value (NAV) of its underlying stocks, an AP can intervene. The AP will buy the actual shares of the 500 companies in the S&P 500 in their correct proportions and deliver this "basket" of stocks to the fund sponsor. In return, the sponsor gives the AP a block of brand-new, equivalent-value SPY shares. The AP then sells these shares on the open market, increasing the supply and helping push the price of SPY back in line with its NAV.

Redemption: The opposite occurs when there is low demand. If SPY's market price falls below its NAV, an AP can buy up large quantities of SPY shares from the open market. The AP then returns these shares to the fund sponsor and receives the corresponding basket of underlying stocks in return. The AP can then sell those individual stocks. This process removes SPY shares from the market, reducing supply and helping to align the ETF's price with its underlying value.

This continuous creation and redemption mechanism is the engine that keeps an ETF's price very close to the actual value of its holdings, ensuring that market participants are paying a fair price.

The question of whether SPY is a "good" investment depends entirely on an individual's financial goals, risk tolerance, and time horizon. It is not a one-size-fits-all solution, but it offers a compelling set of features that make it a cornerstone for many portfolios.

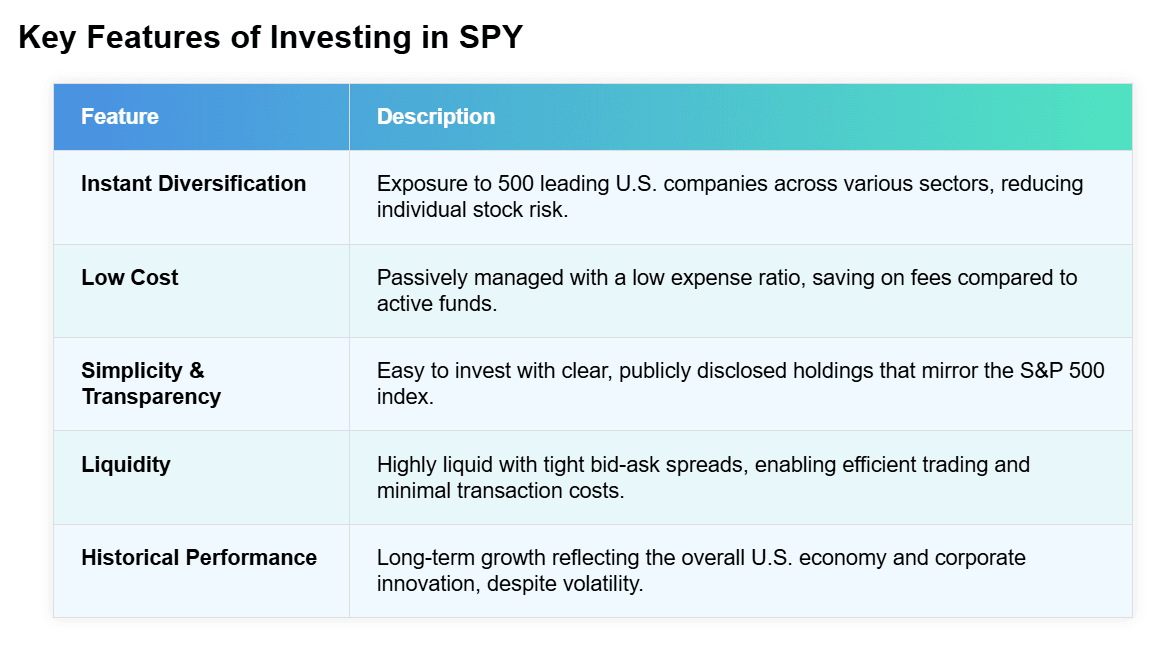

1. Instant Diversification:

The most significant benefit of SPY is immediate diversification. A single share gives you ownership in 500 of America's leading companies across all major industries, including technology, healthcare, financials, consumer discretionary, and more. This diversification spreads risk. If one company or even one sector performs poorly, its impact on the overall portfolio is diluted by the performance of the other 499 constituents. This helps to smooth out returns and reduce the volatility associated with holding individual stocks.

2. Low Cost:

As a passively managed fund, SPY does not require a large team of researchers and portfolio managers to make active stock-picking decisions. Its job is simply to mirror the S&P 500. This results in a much lower operating cost compared to actively managed funds. The fund's expense ratio—the annual fee charged to shareholders to cover administrative and other costs—is very low. Over the long term, these small fee differences can compound into substantial savings, leaving more of the returns in the market participant's pocket.

3. Simplicity and Transparency:

Investing in SPY is straightforward. You do not need to research hundreds of companies or constantly rebalance your holdings. The fund does it for you. Furthermore, its holdings are fully transparent. Because it tracks a public index, you know exactly which companies you are invested in and in what proportions at any given time. This transparency contrasts with some actively managed funds where holdings may be disclosed less frequently.

4. Liquidity:

As one of the most traded securities in the world, SPY offers exceptional liquidity. This means there are always buyers and sellers available, allowing market participants to enter or exit positions quickly and at a price close to the current market value. The bid-ask spread—the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept—is typically very narrow for SPY, which minimizes transaction costs.

5. Historical Performance:

By investing in SPY, you are effectively betting on the long-term growth of the U.S. economy and its largest corporations. Historically, the S&P 500 has demonstrated a durable upward trend over long periods, navigating through recessions, market crashes, and geopolitical events. While past performance is no guarantee of future results, the index's history reflects the resilience and innovation of American enterprise.

1. Market Risk:

While diversified, SPY is not immune to broad market downturns. If the entire U.S. stock market enters a bear market or correction, the value of SPY will fall accordingly. It offers no protection against systemic risk. An investment in SPY is a direct investment in market risk, and its value will fluctuate daily.

2. No Opportunity for Outperformance:

By its very design, a passive index fund like SPY will not outperform its benchmark index. Its goal is to match the market's return, not beat it. Market participants who believe they can generate higher returns through careful stock selection or active management will find SPY's performance inherently limited. You are guaranteed to get the market average, minus a small fee.

3. Concentration Risk:

Although the S&P 500 contains 500 stocks, it is a market-capitalization-weighted index. This means that the largest companies by market value have the biggest impact on the index's performance. In recent years, a handful of mega-cap technology companies have grown to represent a substantial portion of the index's total value. This concentration means that the performance of these few giants can heavily influence SPY's returns, somewhat reducing the benefits of holding 500 different stocks.

4. Dividend Treatment:

As a unit investment trust, SPY cannot reinvest dividends automatically. It collects them and distributes them as cash. For a long-term accumulator, this can create a "cash drag," as the dividends sit idle until they are paid out and manually reinvested. This can lead to slightly lower total returns over time compared to ETFs that can immediately reinvest dividends, benefiting from faster compounding.

SPY's versatility makes it suitable for a wide range of market participants, each using it for different strategic purposes.

1. The Long-Term Passive Investor: For individuals saving for retirement or other long-term goals, SPY can serve as a core holding. Its low cost, diversification, and simplicity make it an ideal "set it and forget it" investment for building wealth over decades. Paired with bond ETFs and international stock ETFs, it can form the foundation of a globally diversified portfolio.

2. The New Investor: Someone just beginning their investment journey may feel overwhelmed by the sheer number of choices available. SPY offers a simple and effective way to get started. It provides broad market exposure without the need for extensive research, allowing beginners to participate in market growth while they learn more about investing.

3. The Active Trader: Despite its passive nature, SPY is a favorite tool of active traders. Its immense liquidity and the availability of a deep options market make it perfect for short-term speculation, hedging, and implementing complex trading strategies. Traders use SPY to make directional bets on the entire market, manage portfolio risk, or generate income through options contracts.

4. The Institutional Investor: Large institutions like pension funds, endowments, and insurance companies use SPY to manage their cash flows and maintain market exposure. If a fund receives a large influx of cash, it can temporarily "park" the money in SPY to ensure it doesn't miss out on market gains while deciding on long-term allocations. This process is known as equitizing cash.

The SPDR S&P 500 ETF is more than just an investment product; it is a fundamental piece of market infrastructure. By providing a low-cost, transparent, and liquid vehicle for investing in the American stock market, SPY has empowered millions to participate in economic growth. It encapsulates the philosophy of passive investing: accepting the market's return is a winning strategy for many, especially over the long run.

However, its utility is not without caveats. It carries inherent market risk, offers no chance of outperformance, and has a structure that can be slightly inefficient for dividend reinvestment. Deciding if SPY is a "good" investment requires a careful assessment of one's own financial situation and objectives. For the long-term accumulator seeking simplicity and broad exposure, it remains an excellent choice. For the tactical trader, it is an indispensable tool. For the stock picker aiming to beat the market, it is the benchmark to be measured against.

Ultimately, the enduring legacy of SPY is its role in democratizing access to the market. It took an abstract concept—the S&P 500 index—and turned it into a tangible, tradable asset available to all. In doing so, it reshaped the investment landscape and established itself as a permanent fixture in the world of finance.

Looking to trade ETF CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.