Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Monday Dec 15 2025 10:19

23 min

What does CFD mean in trading: CFD is a popular financial derivative that enables traders to speculate on the price movements of various assets without actually owning the underlying asset.

CFD trading basics: A CFD allows you to buy or sell the price difference of an asset between the time you open and close your contract. This means you can profit from both rising and falling markets.

CFDs cover various financial instruments, including stocks, commodities, indices, cryptocurrencies, and foreign exchange (forex). By entering a CFD agreement, you enter a contract with your broker to pay the difference in the value of the asset from when you open your position to when you close it.

For instance, if you believe that the price of a stock will rise, you can enter a long position (buy) on a CFD for that stock. Conversely, if you think the price will fall, you can take a short position (sell). The leverage offered in CFD trading allows you to control a larger position than you would typically be able to with your capital alone, magnifying both potential profits and losses.

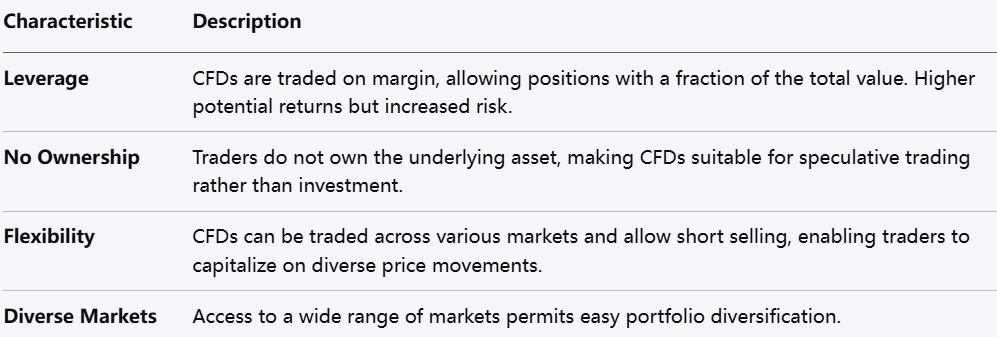

Leverage: CFDs are typically traded on margin, meaning you can open a position with a fraction of the total value. While this allows for higher potential returns, it also increases risk.

No Ownership: When you trade CFDs, you don’t own the underlying asset. This makes CFD trading suitable for speculative trading rather than investment.

Flexibility: CFDs can be traded on various markets without restrictions on short selling. This allows traders to take advantage of price movements in different market conditions.

Diverse Markets: CFDs give access to a wide range of markets, allowing traders to diversify their portfolios easily.

There are several reasons why traders opt for CFD trading, including:

1. Access to Global Markets

CFD trading provides access to various global markets, enabling traders to diversify their portfolios across different asset classes without the need to own the underlying assets. This accessibility can lead to better risk management.

2. Leverage and Margin Trading

One of the most attractive features of CFDs is the ability to use leverage. This means that traders can control a larger position size with a smaller amount of capital. For example, if the leverage is 10:1, you can open a position ten times larger than your capital. However, it’s crucial to remember that while leverage can amplify profits, it can also exacerbate losses.

3. Short Selling Opportunities

CFD trading allows traders to easily take short positions, benefiting from declining markets without the complexities often associated with traditional short selling. This flexibility provides traders with additional opportunities to profit, regardless of market direction.

4. No Stamp Duty

In many regions, trading CFDs does not incur stamp duty, which is a tax charged on the purchase of certain assets. This can make CFD trading more cost-effective compared to physical ownership of assets such as shares.

5. Variety of Trading Strategies

CFDs are flexible instruments that can accommodate various trading strategies, including scalping, day trading, swing trading, and long-term investing. Each trader can tailor their approach based on market conditions and their own risk tolerance.

6. Market Analysis

CFD trading enables traders to utilize technical and fundamental analysis to make informed decisions. With the availability of various analysis tools and platforms, traders can enhance their understanding of market trends and price movements.

7. Low Cost of Entry

CFDs often come with lower initial costs compared to other investment vehicles. Many brokers offer competitive spreads and low commissions, allowing traders to start with manageable capital.

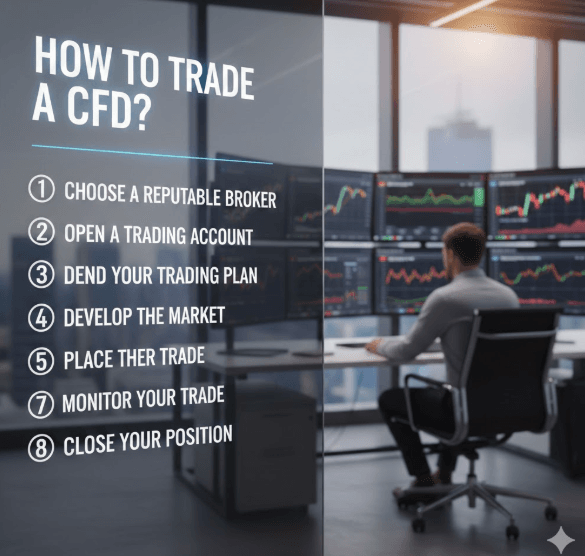

Trading CFDs involves several key steps. Here’s a comprehensive guide to navigating the CFD trading landscape effectively.

Step 1: Choose a Reputable Broker

Selecting a reliable CFD broker is crucial for your trading success. Look for a broker that is regulated by a reputable authority, as this ensures a level of protection for your funds. Factors to consider when choosing a broker include:

Regulation: Ensure the broker is regulated by an established authority, which adds credibility and security.

Trading Platforms: Check if the broker offers a user-friendly trading platform equipped with essential features for technical and fundamental analysis.

Fees and Spreads: Review the commissions, spreads, and overnight fees associated with the broker to assess the overall trading costs.

Customer Support: A responsive customer service team can help resolve any issues you may encounter.

Step 2: Open a Trading Account

Once you’ve selected a broker, you’ll need to open a trading account. This typically involves filling out an application form and providing identification documents, as required by regulations. Many brokers offer different account types, allowing you to choose the one that fits your trading style and objectives.

Step 3: Fund Your Account

To start trading, you need to deposit funds into your trading account. Most brokers offer various funding methods, including bank transfers, credit/debit cards, and e-wallets. It’s important to understand the deposit and withdrawal policies of the broker to avoid unexpected delays.

Step 4: Develop a Trading Plan

A well-defined trading plan is essential for success in CFD trading. Your plan should include:

Trading Goals: Set clear, achievable objectives for your trading performance.

Risk Management: Determine how much capital you are willing to risk on each trade and implement stop-loss orders to manage potential losses.

Trading Strategy: Define the specific strategies you will use for entering and exiting trades, taking into account market analysis and your risk tolerance.

Step 5: Analyze the Market

Conduct thorough market analysis to identify potential trading opportunities. This can involve:

Technical Analysis: Use charts, indicators, and patterns to gauge price movements and market trends.

Fundamental Analysis: Keep abreast of economic news, earnings reports, and other factors that could influence the asset’s price.

Step 6: Place Your Trade

Once you’ve identified a suitable trading opportunity, it’s time to place your trade. Here are the key components to consider:

Choose your position: Decide whether to go long (buy) or short (sell) based on your market analysis.

Set your trade parameters: Specify the size of your trade, any stop-loss and take-profit levels, and whether you want to execute the trade at the market price or set a limit order.

Step 7: Monitor Your Trade

After entering a trade, it’s crucial to monitor its progress. Keep an eye on market conditions that could affect the asset’s price and be prepared to adjust your strategy as needed.

Step 8: Close Your Position

You can close your CFD position at any time. To lock in your profits or minimize losses, decide at what price level you want to exit the trade. Remember that while CFDs can magnify gains, they can also result in significant losses, especially when leveraged.

CFD trading can offer several advantages and challenges for beginners. Understanding these factors can help newcomers make more informed decisions about their trading journey.

Advantages for Beginners

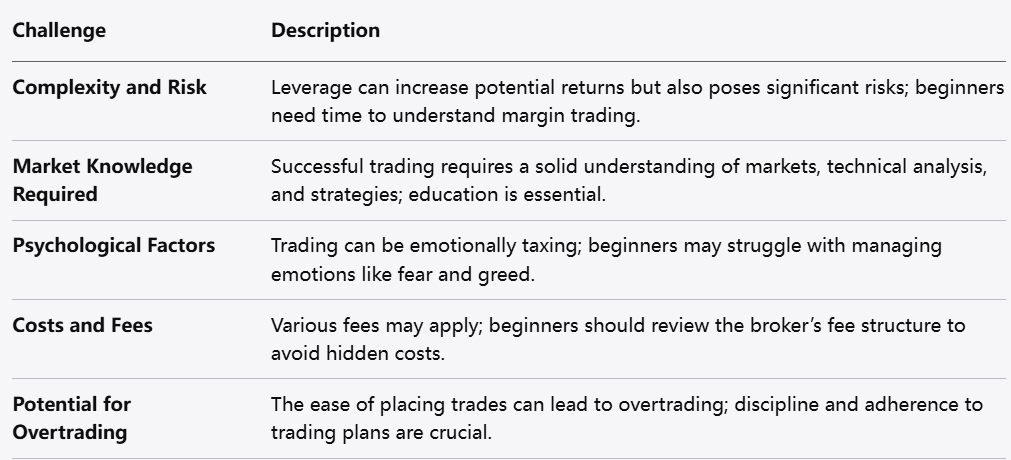

Complexity and Risk: The leverage offered in CFD trading can be enticing but poses significant risks. Beginners may need time to grasp the implications of margin trading and the potential for losses.

Market Knowledge Required: Successful CFD trading typically requires a good understanding of the markets, technical analysis, and trading strategies. Beginners may need to invest time in education before engaging in live trading.

Psychological Factors: Trading can be emotionally taxing. Beginners may struggle with managing the psychological aspects of trading, such as fear, greed, and decision-making under pressure.

Costs and Fees: CFD trading may involve various fees and costs. Beginners should familiarize themselves with the broker’s fee structure to ensure they don’t overlook hidden costs.

Potential for Overtrading: The ease of placing trades can lead to overtrading, which can negatively affect performance. Beginners must remain disciplined and adhere to their trading plans.

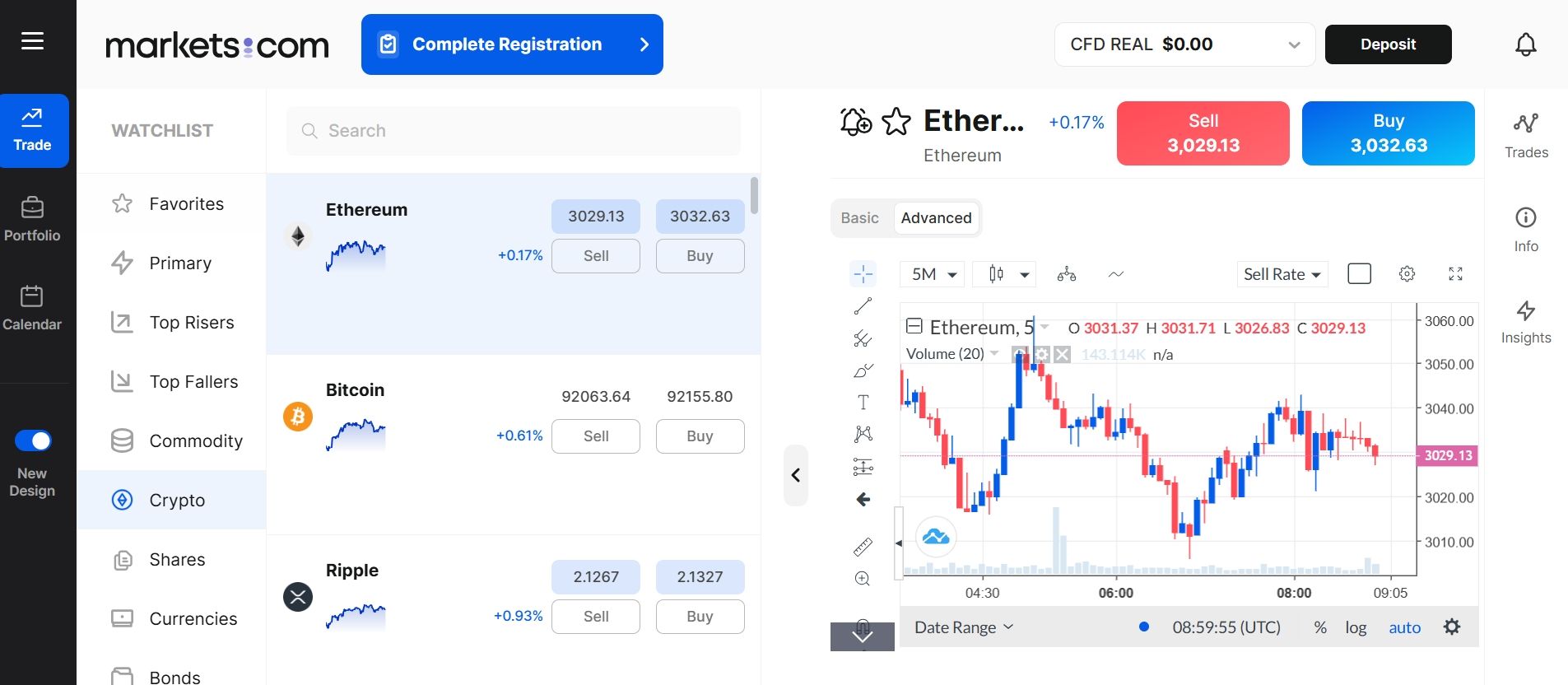

Overview of Markets.com

In the world of CFD trading, selecting the right brokerage can significantly influence your overall trading experience. Markets.com has established itself as a leading CFD broker since its inception, primarily due to its user-friendly platform, comprehensive market access, and strong regulatory background.

Regulation and Trustworthiness

One of the foremost considerations when choosing a trading platform is its regulatory standing. Markets.com operates under the supervision of multiple regulatory bodies such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). This ensures that the broker adheres to high standards of financial practices, providing traders with a sense of security and trust.

Variety of Assets

Markets.com offers a broad range of trading instruments, including forex, commodities, indices, and stocks. This diversity allows traders to develop a well-rounded portfolio aligned with their risk tolerance and market interests. Access to multiple asset classes makes it easier for traders to hedge risks and exploit various market conditions.

User-Friendly Interface

For beginners, the user interface is a critical factor in the trading experience. Markets.com boasts a user-friendly platform that is both intuitive and functional. Whether you are on a desktop or mobile device, navigating through charts, performing technical analysis, and executing trades is seamless.

Educational Resources

Understanding the intricacies of CFD trading can be challenging, particularly for newcomers. Markets.com provides a wealth of educational resources, including articles, webinars, and tutorials. These resources can help traders grasp essential concepts, deepen their market knowledge, and improve their trading strategies.

Competitive Spreads and Leverage

Markets.com is known for its competitive spreads, which can enhance profitability. Additionally, the broker offers leverage, allowing traders to control larger positions with a smaller amount of capital. However, while leverage can amplify profits, it can equally magnify losses, emphasizing the importance of risk management.

Customer Support

Responsive customer support can make all the difference, especially for novice traders who may require assistance. Markets.com provides 24/5 customer support via multiple channels, including live chat, email, and phone. This accessibility ensures that help is readily available whenever needed.

The selection of the right market is crucial for successful CFD trading. The decision will largely depend on your trading goals, risk tolerance, and market conditions. Here are some key factors to consider:

Understanding Market Types

CFD trading encompasses various asset classes. Key markets include:

Researching Market Conditions

Before entering a market, conducting thorough research is necessary to understand its dynamics. Keep an eye on:

Economic Indicators: Data releases such as unemployment rates, inflation figures, and GDP growth can significantly influence market movements.

Geopolitical Events: Political stability and international relations can impact investor sentiment, especially in forex and commodities markets.

Market Sentiment: Use tools like sentiment analysis and news feeds to gauge how other traders are positioning themselves.

Developing a Trading Strategy

Once you’ve selected a market, developing a robust trading strategy is essential. Consider factors such as:

Technical Analysis: Utilize chart patterns, indicators, and historical data to identify potential entry and exit points.

Fundamental Analysis: Monitor news events and data releases that may affect the underlying assets.

Risk Management: Establish parameters for stop-loss and take-profit levels to protect your capital.

Opening a CFD Account: Step-by-Step Guide

Opening a CFD trading account is a straightforward process, but it’s vital to follow each step carefully to ensure compliance and security. Here’s a comprehensive guide:

Executing orders is a critical part of CFD trading. Here’s how to set up and execute your trades effectively:

Understanding Order Types

Before placing a trade, familiarize yourself with different order types:

Market Orders: These are executed immediately at the current market price.

Limit Orders: This order sets a specific price at which you are willing to buy or sell and will only execute if the market reaches that price.

Stop Orders: Used to limit losses, a stop order triggers a market order once a specified price is reached.

Analyzing Market Conditions

Before placing an order, analyze current market conditions. Review your chosen asset’s charts and consider broader market influences to determine a favorable entry point.

Placing Your Order

Log in to Your Trading Platform: Access your account securely.

Select the Asset: Choose the CFD you wish to trade from the available assets list.

Choose Your Order Type: Decide whether to use a market, limit, or stop order based on your strategy.

Specify Position Size: Determine how much you wish to trade within your defined risk management parameters.

Set Stop-Loss and Take-Profit: It’s prudent to set these parameters to protect your investment and lock in profits.

Review and Place Your Order: Double-check your entry details, then confirm and execute the order.

Monitoring Your Trade

After executing your order, it’s vital to monitor its performance actively. Use your broker's trading tools to keep track of price movements, market news, and economic events that could impact your trade. Adjust your stop-loss and take-profit levels as necessary, based on market developments.

How long can I hold a CFD?

The duration for holding a CFD can vary widely depending on market conditions and your trading strategy. Some traders may hold positions for minutes or hours utilizing short-term strategies, while others might maintain ownership for days or weeks based on longer-term analyses. It's essential to consider market volatility and adjust your holding period accordingly.

Is CFD trading safe?

CFD trading carries a certain level of risk. While they provide opportunities for profit, the use of leverage can magnify losses. Understanding market conditions and implementing sound risk management practices can help mitigate some risks. Additionally, choosing a reputable broker is essential for ensuring the safety of your funds.

Is CFD trading legal?

CFD trading is legal in many countries, but regulations vary widely. In some regions, it is highly regulated, while in others, certain restrictions may apply. It is important to consult local laws and the regulations set by your chosen broker to ensure compliance.

What are underlying assets?

Underlying assets are the financial instruments that a CFD is based on. When you trade a CFD, you do not own the underlying asset directly but are instead speculating on its price movements. Common underlying assets include stocks, commodities, forex pairs, and indices.

CFD trading offers a myriad of opportunities for traders, particularly in terms of flexibility, access to global markets, and the ability to profit in both rising and falling markets. However, it also encompasses significant risks, especially when leveraged.

For beginners looking to enter the world of CFD trading in 2026, understanding the fundamentals of CFDs, the mechanics of trading, and the associated risks is crucial. By selecting a reputable broker, developing a solid trading plan, and continuously improving their market knowledge, novice traders can build a foundation for a successful trading journey.

With proper education and discipline, beginners can navigate the exciting yet challenging landscape of CFD trading, unlocking its potential to achieve their financial goals.

CFD trading presents an exciting opportunity to engage with various markets, offering flexibility and potential for profit. By selecting a reputable broker like Markets.com, choosing the right markets, carefully opening a trading account, and understanding how to execute trades, you can navigate the complexities of this financial avenue. While potential challenges exist, equipping yourself with knowledge and strategies can pave the way for a fruitful trading experience in 2026 and beyond.

Looking to trade CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.