Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Wednesday Nov 19 2025 10:23

11 min

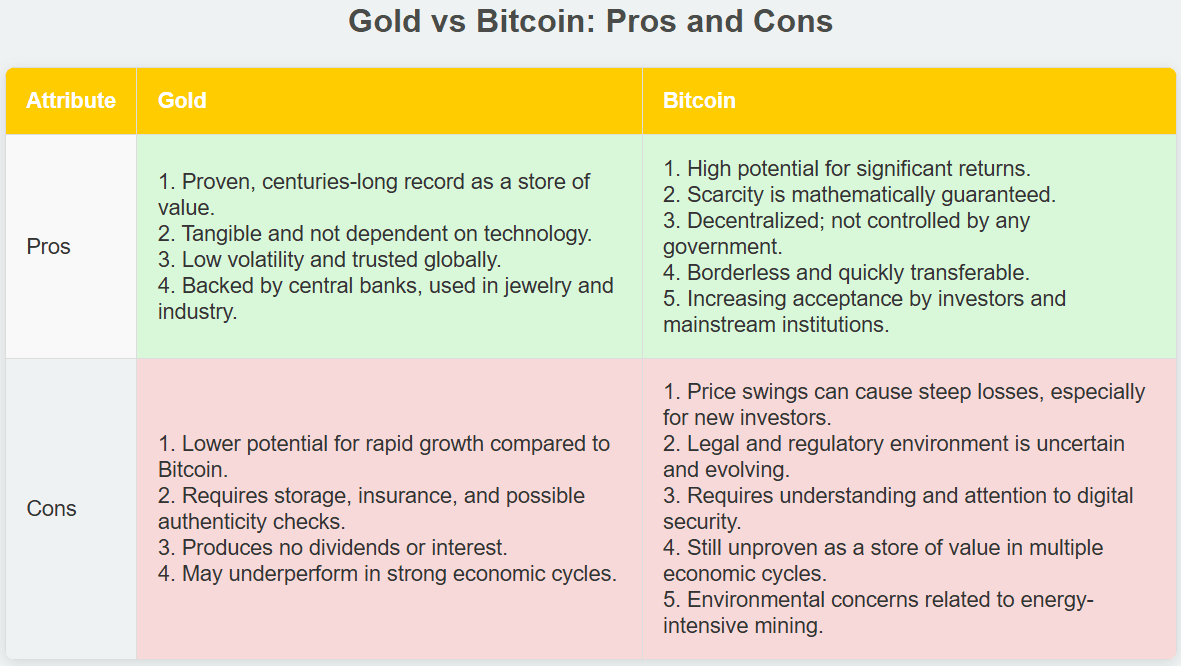

Investment for beginners: Gold is history’s classic safe haven, Bitcoin offers digital innovation and disruptive potential.

Is it better to buy gold: If you’re torn between these options, this guide will help by outlining their key features, risks, and benefits so you can make an informed decision that suits your goals and risk tolerance.

Gold: The Timeless Store of Value

Gold has been prized for thousands of years due to its rarity, durability, and intrinsic value. Used as money, a symbol of wealth, and a hedge against economic instability, gold’s enduring appeal rests on its physical presence and the confidence it inspires during turbulent times. It is tangible, universally recognized, and has a supply that increases only slowly.

Bitcoin: The Digital Pioneer

Created in 2009, Bitcoin is the original decentralized digital currency. Designed to exist outside government control, it operates on the blockchain—a transparent, tamper-resistant ledger. Bitcoin’s appeal lies in its absolute scarcity (a capped supply of 21 million coins), borderlessness, and the promise of democratizing finance. It has become popular for its perceived potential as “digital gold,” but also carries a unique set of risks.

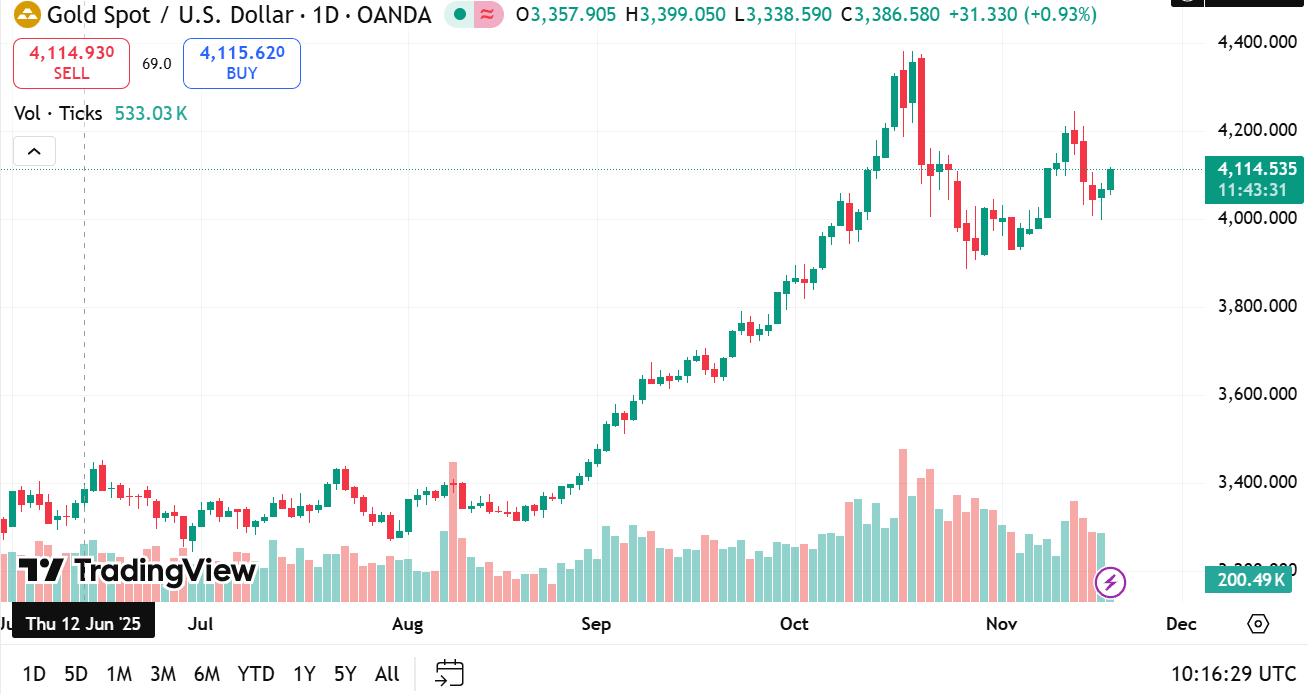

Gold’s Track Record

Gold has consistently retained value through centuries of wars, inflation, and changing economies. It tends to rise during periods of crisis or high inflation and remains stable during market turbulence. That said, gold is not a fast-growth asset; its price movements are generally slow, lacking the dramatic swings seen in stocks or cryptocurrencies. This steadiness makes gold attractive to conservative investors but less appealing to those chasing high returns.

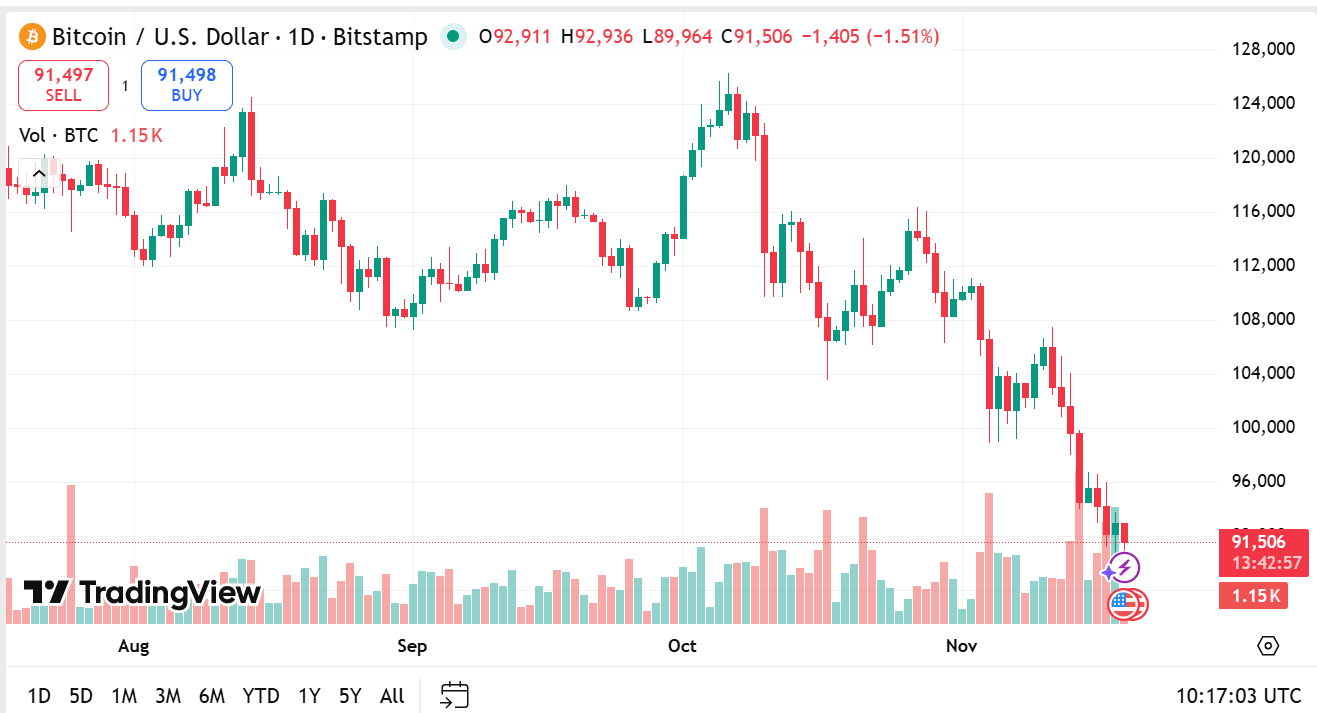

Bitcoin’s Rollercoaster

By contrast, Bitcoin’s history is short and marked by extreme volatility. Its meteoric price surges made headlines, drawing both enthusiastic adopters and risk-wary critics. Major gains are often followed by steep corrections, and price swings of 10% or more in a day are not unusual. While its overall long-term trend has been upward, investing in Bitcoin demands resilience to withstanding sharp downturns.

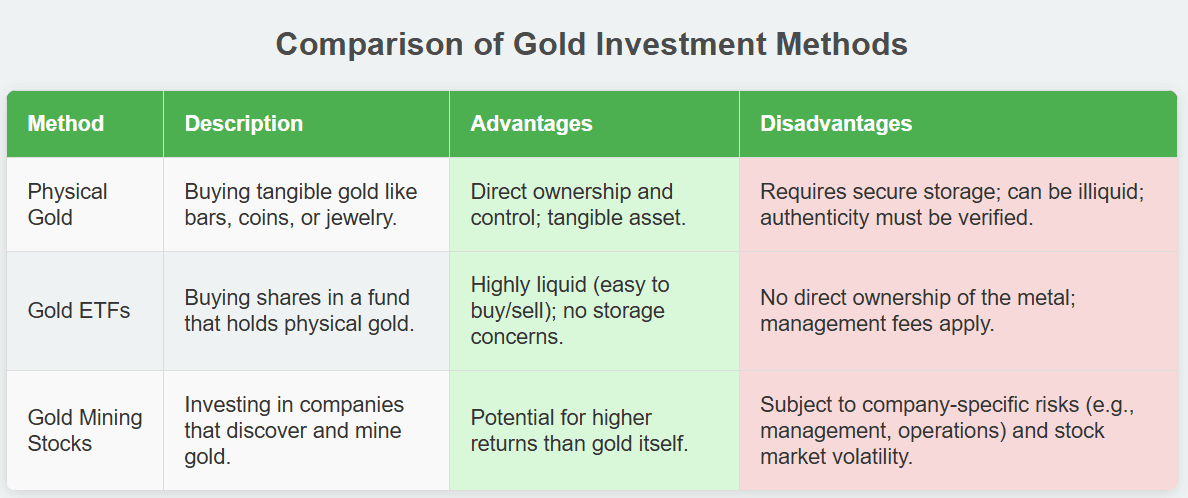

How to Invest in Gold

Physical Gold: Buying gold bars, coins, or jewelry is the simplest method, granting direct ownership. You’ll need to ensure authenticity and arrange for secure storage (home safes, bank boxes, or third-party vaults). Selling gold requires finding buyers and may incur fees.

Gold ETFs: Exchange-traded funds allow you to own shares in funds that hold gold. ETFs are highly liquid, can be traded like stocks, and remove the need for storage. However, you don’t hold the metal directly.

Gold Mining Stocks: You can also invest in companies that mine gold. Performance depends on both gold prices and company management, adding another layer of risk and opportunity.

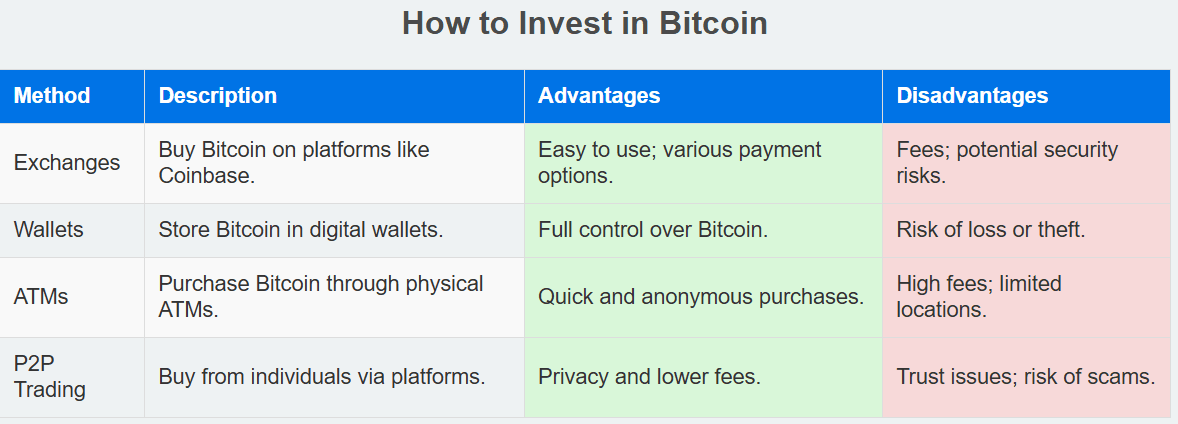

How to Invest in Bitcoin

Cryptocurrency Exchanges: The most common way is via online exchanges, where you can buy Bitcoin in full units or fractions. Setting up an account is typically straightforward but requires identity verification.

Wallets: Once you own Bitcoin, you can store it on the exchange or transfer it to a digital wallet. Software wallets (mobile or desktop) are convenient but vulnerable to hacking. Hardware wallets (physical devices) provide greater security but require you to manage keys responsibly.

Bitcoin ETFs/Trusts (where available): In some regions, you can invest in funds that track Bitcoin, just as with gold ETFs, providing exposure without the need for wallets or private keys.

Risks of Gold

source: tradingview

Gold is considered stable, but its main risk is stagnation—its value may not grow significantly over long stretches, especially during economic booms. Physical gold has security considerations; storage and insurance entail extra costs. Opportunity cost is also real: in bull markets for stocks or cryptocurrencies, gold may underperform.

Risks of Bitcoin

source: tradingview

Bitcoin’s headlines come from its volatility. Dramatic price swings, often triggered by regulatory changes, internet news, or large trades, can mean rapid gains—or losses. Specific risks include:

Regulation: Governments may change laws or restrict crypto usage, impacting value and accessibility.

Technology: The robustness of the blockchain is strong, but advances like quantum computing could pose future threats.

Security: Holding Bitcoin requires careful storage of passwords and devices. Exchange hacks and lost passwords can mean permanent loss.

Gold’s Value Beyond Investment

Jewelry: A majority of gold demand comes from jewelry, making its desirability partly aesthetic.

Industry: Gold is used in electronics and medicine, thanks to its conductivity and resistance to corrosion.

Central Banks: Nations keep gold reserves as a backbone of economic security.

Bitcoin’s Expanding Role

Payments: While not widely used for daily purchases due to volatility and slow transaction times, Bitcoin shines in international transfers.

Store of Value: Many view Bitcoin as a modern hedge against inflation and currency risk.

Foundation for DeFi: Bitcoin inspired a growing world of decentralized financial applications and has become the reference point for innovation in the space.

Gold’s Enduring Importance

Gold remains a favored asset for both private investors and governments during uncertain times. Its global recognition and demand for jewelry and industry likely secure its place for decades to come. However, as digital nativity increases and the world embraces new technologies, gold may face competition from digital alternatives for investment dollars.

Bitcoin’s Future

Bitcoin’s long-term outlook is highly debated. Proponents believe it will continue to attract mainstream adoption and broader institutional interest, potentially cementing its position as “digital gold.” Detractors see its volatility, security risks, and regulatory uncertainty as hurdles that could limit its potential. Its future is tied to broader trends in technology, finance, and law.

Choosing between gold and Bitcoin as a beginner comes down to your personal preferences, investment goals, and comfort with risk.

Gold is best for those seeking stability, a track record across centuries, and a hedge against uncertainty. It’s a safe haven but unlikely to offer explosive returns. Think of gold as your portfolio’s anchor.

Bitcoin is suited for those willing to accept more risk for a chance at higher returns and who have faith in technological progress. It can be a dynamic, high-growth allocation but should be approached with caution—only invest what you’re comfortable potentially losing due to its volatility.

Consider Diversification: You don’t have to pick only one. Some beginners put a majority of their alternative assets in gold and reserve a small percentage for Bitcoin, balancing classic safety with digital potential.

Final guidance: Always research before investing. Learn how to securely store your asset, start modestly, and understand your risk tolerance. Whether you choose gold, Bitcoin, or a thoughtful blend of both, investing is a journey—steady, well-informed steps will serve you best as you build your financial future.

Looking to trade gold or bitcoin CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.