Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Wednesday Dec 10 2025 10:19

25 min

Financial market for beginners: Understanding financial markets can seem daunting for beginners. However, grasping the basics is crucial for anyone looking to invest.

Start investing in 2026: This article will provide a comprehensive overview of how financial markets operate, the types of markets, and essential tips for investing.

Financial markets are platforms where buyers and sellers engage in the trading of assets, such as stocks, bonds, currencies, and commodities. These markets facilitate the exchange of capital and provide mechanisms for price discovery, liquidity, and risk management.

Purpose of Financial Markets

Price Discovery: Financial markets help determine the price of assets based on supply and demand.

Liquidity: They provide participants with the ability to quickly buy or sell assets, ensuring that assets can be converted to cash with relative ease.

Risk Management: Markets offer tools like derivatives that allow participants to hedge against potential losses.

Capital Formation: They enable businesses to raise funds by issuing stocks and bonds, which can be used for expansion and operational needs.

Types of Financial Markets

Understanding the various types of financial markets is essential for potential investors.

1. Stock Markets

Stock markets are where shares of publicly traded companies are bought and sold. These markets allow companies to raise capital by selling ownership stakes to the public.

Primary Market

In the primary market, new issues of stocks (initial public offerings, or IPOs) are sold to investors. The proceeds from these sales go directly to the issuing company.

Secondary Market

In the secondary market, existing shares are traded among investors. The issuing company does not receive any money from these transactions.

2. Bond Markets

Bond markets involve the issuance and trading of debt securities. When you purchase a bond, you are essentially lending money to the issuer (e.g., government or corporations) in exchange for interest payments and the return of principal at maturity.

3. Forex Markets

The foreign exchange (Forex) market is where currencies are traded. It is the largest financial market in the world, operating 24 hours a day and facilitating international trade and investment.

4. Commodity Markets

Commodity markets deal with the buying and selling of physical goods, such as gold, oil, and agricultural products. Investors can trade these commodities directly or through derivative contracts.

5. Derivative Markets

Derivative markets involve financial instruments whose value is derived from an underlying asset. Common derivatives include options and futures, which allow investors to speculate on or hedge against future price movements of the underlying assets.

Market Participants

Various participants occupy financial markets, each with different motivations:

Individual Investors: Retail investors looking to grow wealth over time through stocks, bonds, and other assets.

Institutional Investors: Entities such as pension funds, mutual funds, and hedge funds that invest large amounts of capital.

Brokers and Dealers: Individuals or firms that facilitate transactions between buyers and sellers, earning commissions or fees in the process.

Market Makers: Firms that provide liquidity by consistently buying and selling securities, ensuring there is always a market for them.

Financial Market Structure

Financial markets can be structured in different ways, typically as either exchanges or over-the-counter (OTC) markets.

Exchanges

Exchanges are centralized marketplaces where securities are traded, such as the New York Stock Exchange (NYSE) and the Nasdaq. They provide transparency and regulated environments for trading.

Over-the-Counter (OTC) Markets

OTC markets involve decentralized trading between participants directly, without a formal exchange. This is common for bonds, derivatives, and currencies.

1. Setting Investment Goals

Before diving into investing, it's crucial to set clear financial goals. Consider the following:

Time Horizon: How long do you plan to invest? Short-term goals may require different strategies than long-term goals.

Risk Tolerance: Understand your ability to endure market fluctuations without panicking. More volatile investments may suit higher risk tolerance, while conservative investments may align with lower risk levels.

Financial Objectives: Are you looking for growth, income, or capital preservation? Your objectives should guide your investment strategy.

2. Creating an Investment Plan

An investment plan outlines how you will achieve your financial goals.

Asset Allocation: Determine how to spread your investments across different asset classes (e.g., stocks, bonds, real estate) to fit your risk profile and objectives.

Diversification: Spread investments across various sectors and regions to reduce risk.

Regular Contributions: Consider setting up automatic contributions to your investment accounts to build wealth over time.

3. Choosing an Investment Account

Investors typically use brokerage accounts to purchase assets. There are various types of accounts to consider:

Taxable Accounts: Standard brokerage accounts where capital gains and dividends are taxed.

Retirement Accounts: Accounts like IRAs and 401(k)s that offer tax advantages for retirement savings. Contributions may be tax-deductible, and gains may grow tax-deferred.

4. Selecting Investment Vehicles

Investors can choose from a variety of investment vehicles:

Stocks: Individual stocks represent ownership in companies.

Mutual Funds: Pooled funds managed by professionals, investing in a diversified portfolio of stocks and bonds.

Exchange-Traded Funds (ETFs): Similar to mutual funds but traded like stocks on an exchange, often with lower fees.

Bonds: Debt securities that pay interest over time and return principal at maturity.

5. Conducting Research

Before making investment decisions, conduct thorough research to understand potential investments. Key factors to analyze include:

Company Fundamentals: Look at earnings, revenue growth, profit margins, and balance sheets for stocks.

Market Trends: Understand the broader economic and industry trends that may impact various sectors.

Valuation Metrics: Learn how to evaluate whether a stock is overvalued or undervalued using metrics like price-to-earnings (P/E) ratios.

6. Monitoring Your Investments

After investing, it’s important to regularly review your portfolio’s performance and make adjustments as needed.

Performance Tracking: Assess whether your investments are meeting your initial goals.

Rebalancing: Periodically adjust your portfolio to maintain your desired asset allocation.

Staying Informed: Keep up with market news and economic indicators that may affect your investments.

7. Learning About Risk Management

Understanding and managing risk is crucial for successful investing.

Understanding Volatility: Recognize that markets can be unpredictable, and prices can fluctuate.

Setting Stop-Loss Orders: Consider using stop-loss orders to limit potential losses on individual investments.

Emergency Fund: Maintain an emergency fund to cover unexpected expenses, ensuring you won’t need to sell investments in a downturn.

The Role of Psychology

Investor psychology plays a significant role in market dynamics. Emotions such as fear and greed can heavily impact decision-making. Understanding your psychological biases can help you make more rational investment choices.

Common Behavioral Biases

Overconfidence: Investors may overestimate their ability to predict market movements.

Loss Aversion: Many people fear losing money more than they desire to make profits, which can lead to poor decision-making.

Herd Behavior: The tendency to follow the crowd can lead to buying at market peaks and selling during downturns.

Strategies to Combat Emotional Decision-Making

Stick to Your Plan: Always adhere to your investment strategy regardless of market fluctuations.

Educate Yourself: The more knowledgeable you are, the more confident you will feel navigating the investment landscape.

Consider Automatic Investing: Using automated tools and strategies can help mitigate the impacts of emotional decision-making.

Value Investing

Value investing focuses on finding undervalued stocks or securities that exhibit strong fundamentals. Investors seek to buy these assets at a discount, believing that the market will eventually recognize their true worth.

Growth Investing

Growth investing involves targeting companies with strong growth potential, even if their current valuations are high. Growth investors are willing to pay a premium for stocks expected to provide substantial future earnings.

Income Investing

Income investing centers on generating cash flow through dividends or interest. Investors typically focus on stocks with reliable dividend growth or bonds that pay steady interest.

Passive vs. Active Investing

Passive Investing: Involves buying and holding a diversified portfolio for the long term, often using index funds or ETFs that track market benchmarks.

Active Investing: Requires a more hands-on approach, where investors make frequent trades to exploit short-term market fluctuations. This strategy can involve higher costs and requires more time and expertise.

Options Trading

Options trading offers investors the ability to speculate on the future price of an asset or hedge against potential losses. It involves contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. While options can enhance returns, they also carry substantial risks and complexity.

Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy that involves regularly investing a fixed amount of money into a specific asset, regardless of its price. This approach can mitigate the impact of volatility and reduce the risk of making poor decisions based on short-term market fluctuations.

Chasing Trends

Many beginners fall into the trap of buying stocks based on current trends without understanding the fundamentals. Always conduct thorough research before investing.

Timing the Market

Trying to predict market highs and lows can lead to significant losses. Focus on a long-term investment strategy rather than attempting to time your entry and exit.

Ignoring Fees and Expenses

High fees and expenses can erode potential returns over time. Always consider the costs associated with your chosen investment vehicles and platforms.

Neglecting Diversification

Putting all your eggs in one basket increases risk. Ensure that your portfolio is well-diversified across various asset classes, sectors, and geographic regions.

Emotional Decision-Making

Investing can evoke strong emotions, leading to impulsive decisions. Stick to your investment strategy and avoid making changes based purely on market sentiment.

Books

"The Intelligent Investor" by Benjamin Graham: This classic book on investing provides timeless principles for growing wealth intelligently.

"A Random Walk Down Wall Street" by Burton Malkiel: This book offers insights into market behavior and investment strategies suited for beginners.

Online Courses

Many platforms offer affordable courses on investing and financial markets. Look for courses on platforms like Coursera, Udemy, or Khan Academy that cater to beginners.

Financial News Outlets

Staying informed about market trends and developments is essential. Consider subscribing to financial news outlets like Bloomberg, CNBC, or The Wall Street Journal for the latest news and analysis.

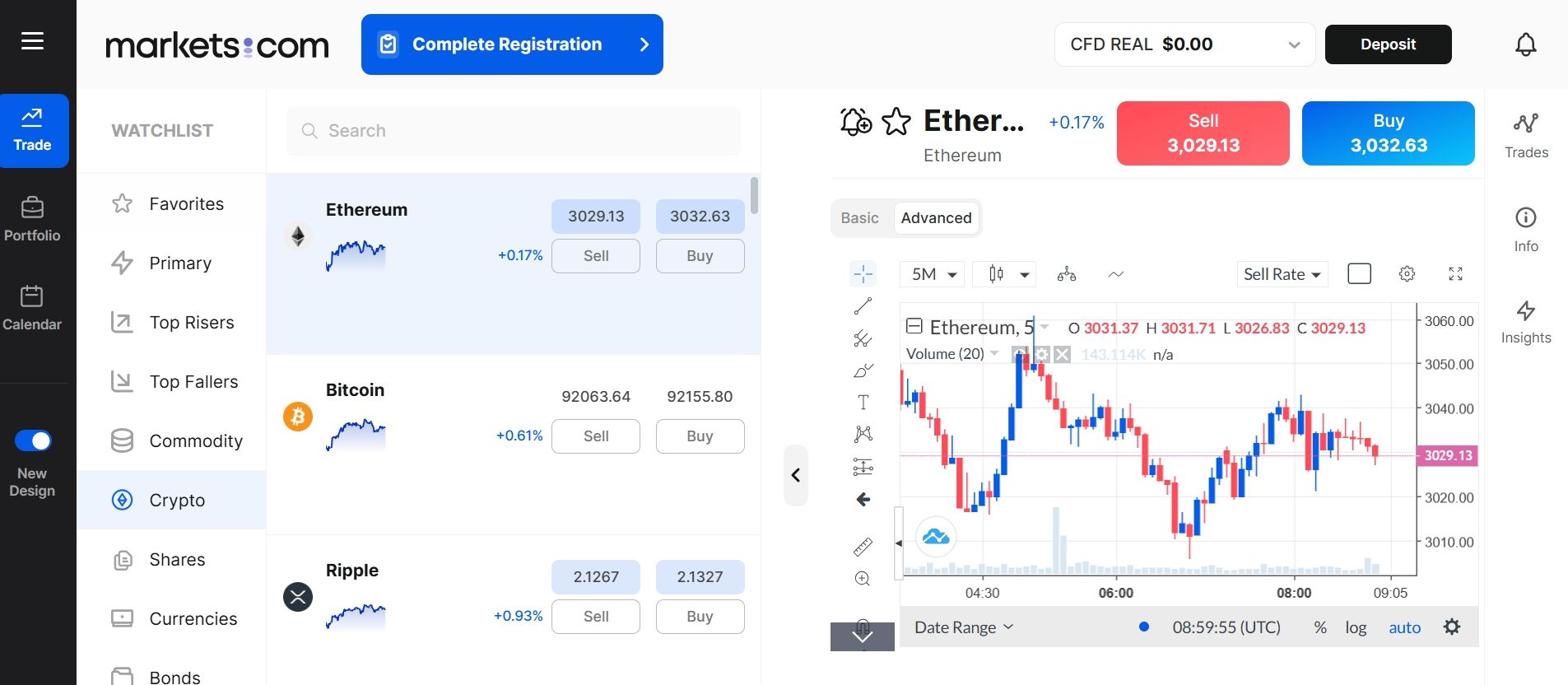

As the trading landscape evolves in 2026, several brokers have emerged as preferred choices for traders seeking low-cost Contract for Difference (CFD) options. Among these, Pepperstone, IC Markets, and Markets.com stand out due to their competitive pricing structures, comprehensive trading features, and robust market access. For traders looking to maximize profits while minimizing expenses, these brokers offer appealing solutions.

Pepperstone

Pepperstone remains a leading choice for both novice and experienced traders. Known for its low spreads, which can start from as low as 0.0 pips on certain accounts, Pepperstone also offers commission-free trading on its Standard account. The broker provides access to a wide range of markets, including forex, commodities, and indices, alongside superior execution speeds. Their user-friendly trading platform, including MetaTrader 4 and 5, helps traders easily navigate and execute trades efficiently.

IC Markets

IC Markets has also garnered attention for its cost-effective CFD trading solutions. With some of the lowest spreads in the industry, starting from 0.1 pips, IC Markets caters to aggressive traders and scalpers. The broker supports multiple asset classes and offers diverse trading platforms, including cTrader in addition to MetaTrader. Their transparent fee structure ensures that traders can effectively manage costs while leveraging advanced trading tools. This combination of low fees and extensive market access positions IC Markets as a frontrunner in the CFD space.

Markets.com

Markets.com offers a blend of low trading costs and a comprehensive trading experience. With competitive spreads and no hidden fees, Markets.com provides traders with transparency and ease of use. The broker features a powerful proprietary platform that incorporates advanced charting tools and educational resources, helping traders make informed decisions.

Markets.com's customer support and regulatory compliance further enhance their appeal, making Markets.com a viable option for those interested in low-cost CFD trading in 2026.

Exchange-Traded Funds (ETFs) have gained significant popularity among investors due to their unique structure and benefits. Understanding what ETFs are and how they function in the trading world can help investors make informed decisions.

Definition of ETFs

ETFs are investment funds that hold a collection of different assets, such as stocks, bonds, commodities, or other securities. These funds are traded on stock exchanges, similar to individual stocks, allowing investors to buy and sell shares throughout the trading day. An ETF typically aims to track the performance of a specific index, sector, or commodity, providing investors with a diversified investment in a single product.

How ETFs Are Structured

ETFs are created by financial institutions that purchase the underlying assets and package them into a fund. Investors can then buy shares of this fund on an exchange. Each share of the ETF represents a proportional interest in the underlying assets, which means that as the value of the assets increases or decreases, so does the value of the ETF shares. This structure allows for easy diversification, as one ETF can offer exposure to multiple securities.

Benefits of Investing in ETFs

1. Diversification

One of the primary advantages of ETFs is the built-in diversification they provide. Instead of purchasing individual stocks or bonds, investors can buy a single ETF that represents a broad market index or a specific sector. This spreading of risk can help reduce the impact of any single asset's poor performance on an investor's overall portfolio.

2. Liquidity

ETFs offer high liquidity, making it easy for investors to enter or exit their positions. Since ETFs are traded on major stock exchanges, they can be bought or sold throughout the trading day, similar to stocks. This allows for flexibility in trading strategies, enabling investors to respond quickly to market changes.

3. Cost Efficiency

Compared to mutual funds, ETFs generally have lower expense ratios. This means investors can keep more of their returns, as the costs associated with managing the fund are lower. Additionally, many ETFs have no minimum investment requirements, making them accessible to a wide range of investors.

4. Transparency

ETFs often provide transparency in their holdings, allowing investors to see what assets are included in the fund. Many ETFs disclose their holdings on a daily basis, giving investors insight into their investments and enabling them to make informed decisions.

Types of ETFs

Several types of ETFs cater to different investment strategies and goals:

1. Equity ETFs

These ETFs invest primarily in stocks and aim to replicate the performance of a specific index, such as the S&P 500 or the Nasdaq. Equity ETFs are popular among investors seeking exposure to various sectors of the market.

2. Bond ETFs

Bond ETFs invest in fixed-income securities. They can provide investors with a steady income stream and are often used to diversify portfolios with lower volatility compared to stocks.

3. Commodity ETFs

Commodity ETFs invest in physical commodities such as gold, silver, oil, or agricultural products. These ETFs allow investors to gain exposure to commodity markets without the complexities of directly buying and storing physical goods.

4. Sector and Thematic ETFs

These ETFs focus on specific sectors (like technology or healthcare) or investment themes (such as renewable energy). They allow investors to target particular areas of the market.

ETFs have revolutionized the way investors approach portfolio management and trading. Their versatility, cost-effectiveness, and ease of trading make them suitable for both novice and experienced investors. By providing exposure to a diversified range of assets, ETFs help investors build resilient portfolios. As with any investment, understanding the risks and benefits associated with ETFs is crucial for making informed decisions in the trading world.

Understanding the distinction between trading and investing is crucial for anyone interested in financial markets. Each approach offers unique strategies, risks, and potential rewards, making it essential to identify which aligns better with your personal goals and risk tolerance.

The Nature of Trading

Trading typically involves the frequent buying and selling of financial instruments with the aim of profiting from short-term price movements. Traders often operate on shorter time frames, making decisions based on technical analysis, charts, and market news. They look for patterns in price movements and use various indicators to gauge market sentiment.

Traders can span various styles and time frames, including day trading, swing trading, and scalping. Day traders, for instance, buy and sell stock within the same trading day, attempting to capitalize on small price movements. Swing traders hold positions for several days or weeks, targeting more significant fluctuations in price. Scalpers may make dozens or even hundreds of trades in a day, seeking tiny profits on each transaction.

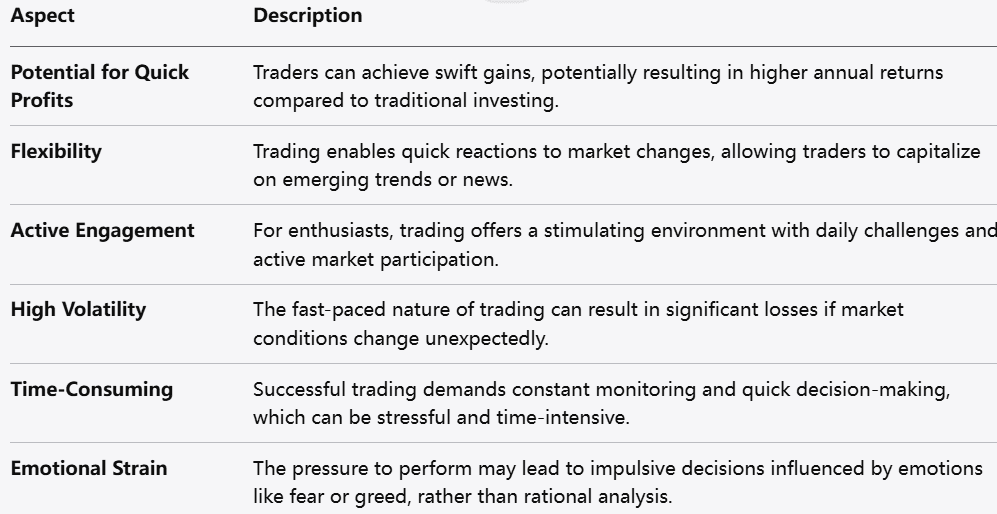

Advantages of Trading

Potential for Quick Profits: Traders can realize gains swiftly, which may lead to higher annual returns compared to traditional investing.

Flexibility: Trading allows individuals to react quickly to market changes, taking advantage of emerging trends or news.

Active Engagement: For those who enjoy the excitement of markets, trading can be a stimulating activity with daily challenges.

Risks of Trading

High Volatility: The fast-paced nature of trading can lead to significant losses if market conditions shift unexpectedly.

Time-Consuming: Successful trading requires constant monitoring and quick decision-making, which can be demanding and stressful.

Emotional Strain: The pressure to perform can lead to impulsive decisions driven by fear or greed rather than sound analysis.

The Nature of Investing

Investing, on the other hand, is centered around the long-term growth of capital through the purchase of assets expected to increase in value over time. Unlike trading, which focuses on short-term gains, investing emphasizes sound fundamentals and the long-term potential of an asset. Investors typically analyze a company’s financial health, market position, and future growth opportunities.

Long-term investors may choose to allocate their funds to a diversified portfolio, including stocks, bonds, real estate, and mutual funds. They often have a buy-and-hold strategy, believing that over time, even if the market fluctuates, the value of their investments will appreciate.

Advantages of Investing

Risks of Investing

Market Exposure: Investments can be affected by economic downturns, and the value may decline over time before recovering.

Delayed Gratification: Investors must be patient, and waiting for returns might be challenging in a culture that often seeks immediate results.

Less Liquidity: Depending on the investment type, it may take time to sell and access funds.

Which is Better for You?

The choice between trading and investing often depends on individual objectives and preferences. If you have a high-risk tolerance, enjoy analyzing trends, and have the time to dedicate to the financial markets, trading might suit you. However, if you prefer a more stable, long-term approach mostly focused on achieving financial goals through gradual growth, investing is likely the better option.

Ultimately, both strategies require education, discipline, and a clear understanding of the risks involved. Whichever path you choose, making informed and calculated decisions will be critical to your financial success.

(1) Open Your Account:

Begin by registering for a trading account with Markets.com. The process is fast, secure, and hassle-free.

(2) Fund Your Account:

After activation, deposit funds using one of the many secure payment methods offered by Markets.com for your convenience.

(3) Research the Gold Market:

Take time to understand the factors influencing gold prices. Analyze market trends, review technical charts, and create a trading strategy that suits your risk tolerance.

(4) Execute Your First Trade:

Once your research is complete, you'll be ready to make your first gold CFD trade.

Investing in financial markets can be a rewarding endeavor if approached with knowledge and discipline. By understanding how financial markets operate, recognizing investment opportunities, and adhering to sound strategies, beginners can build pathways to financial growth. Over time, continued education and adaptation to market conditions will be essential for long-term investment success.

As you embark on your investment journey, remember that patience is key. The financial markets are influenced by a multitude of factors, and keeping a long-term perspective can help you navigate the inevitable ups and downs. Seek advice when needed, continuously educate yourself, and ensure that your investment strategies align with your personal financial goals. Begin your journey with confidence, and remember that successful investing is about making informed, thoughtful decisions rather than quick wins.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.