Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Monday Jan 19 2026 10:54

20 min

Crypto trading basics: The cryptocurrency market has emerged as one of the most dynamic and volatile financial arenas in recent years.

With the potential for substantial returns, many investors and traders are eager to enter the space. However, the complexities and rapid fluctuations can be daunting, leading many to seek tools that can guide them through the trading process. One such tool is crypto signals. This article will explore the basics of crypto trading, explain what crypto signals are, how to use them effectively, and why they have garnered significant popularity among traders.

What Is Cryptocurrency?

Cryptocurrency is a form of digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized technology called blockchain. This technology ensures transparency and security, making it difficult for unauthorized parties to alter transaction data.

The Rise of Cryptocurrency Trading

The rise of cryptocurrencies has revolutionized finance. With Bitcoin as the pioneer and the subsequent emergence of thousands of alternative coins, many see cryptocurrencies not just as a mode of exchange but also as a speculative investment. The allure of high volatility can lead to significant price movements, attracting traders looking for quick gains.

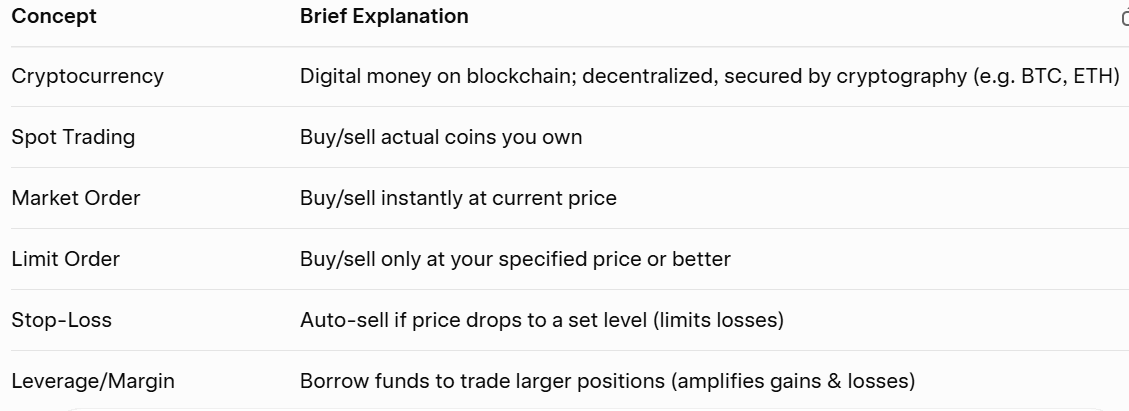

Before diving into the specifics of crypto signals, it is essential to grasp some fundamental concepts in trading:

Market Orders vs. Limit Orders: A market order buys or sells a cryptocurrency immediately at the best available price, while a limit order sets a specific price at which the trader wishes to buy or sell.

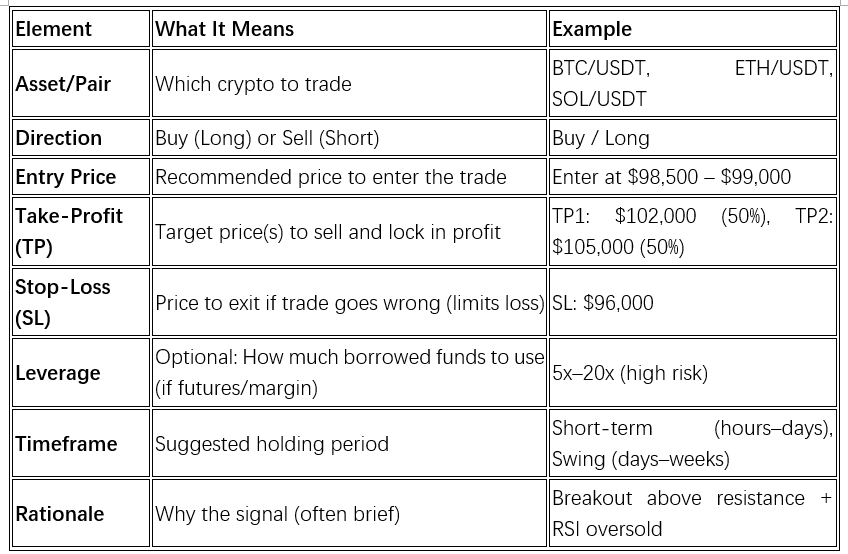

Technical Analysis: This involves analyzing price charts and indicators to predict future price movements. Traders use patterns, trends, and various indicators to make informed decisions.

Fundamental Analysis: Unlike technical analysis, fundamental analysis focuses on the underlying value of a cryptocurrency. It considers factors like the technology behind the coin, its use case, and the team working behind the project.

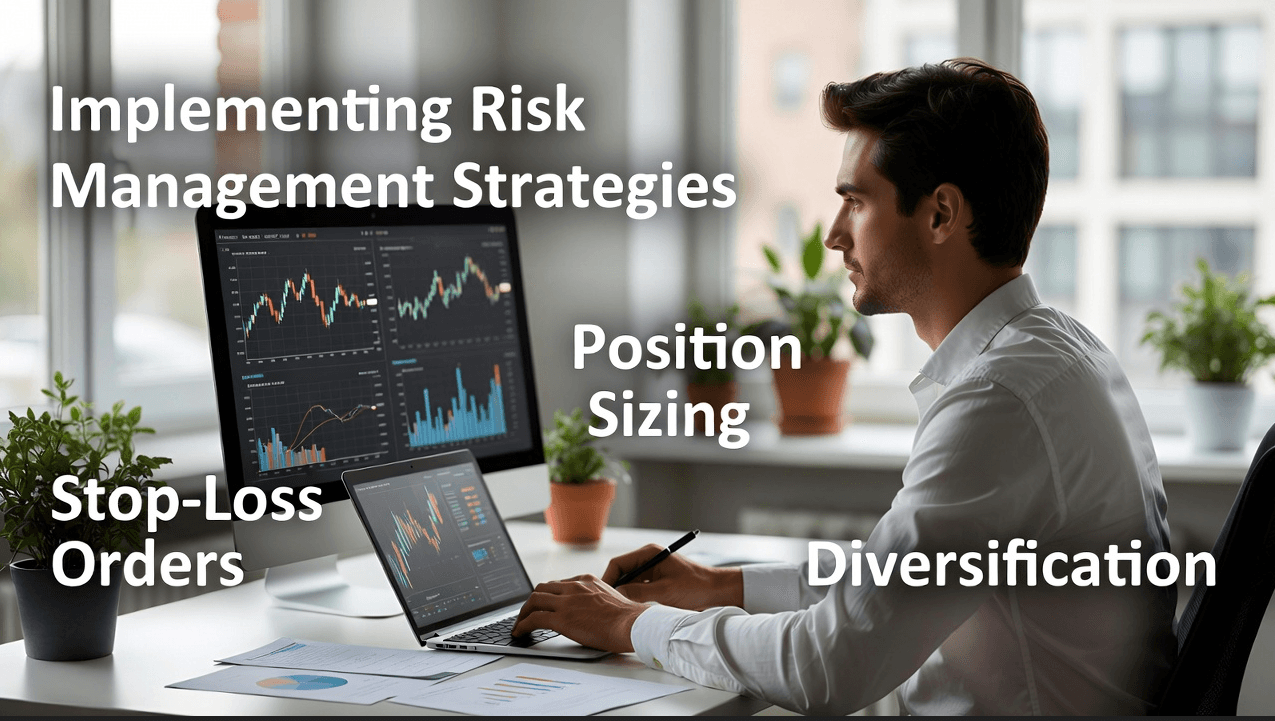

Risk Management: Since the crypto market is highly volatile, managing risk is crucial. This includes setting stop losses to limit potential losses and diversifying a portfolio to spread risk.

Definition of Crypto Signals

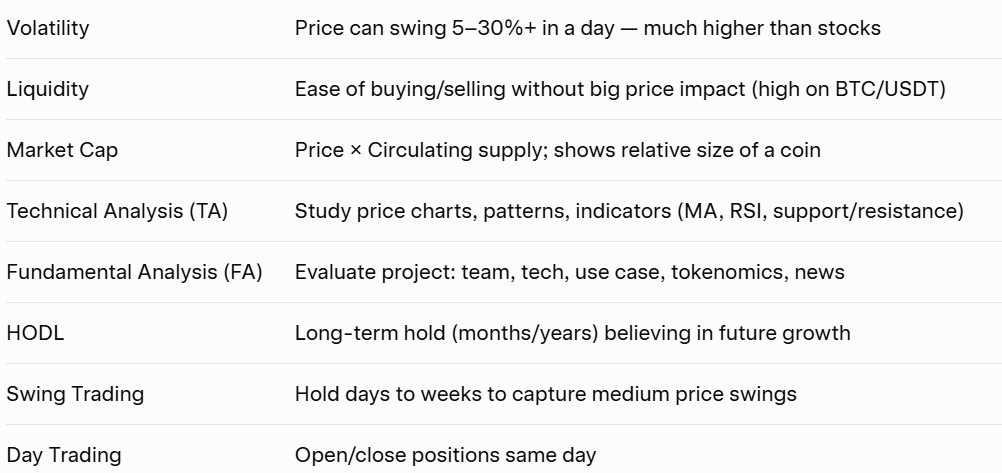

Crypto signals are trade recommendations that indicate when to buy or sell a specific cryptocurrency. These signals often include details such as the entry price, exit target, and stop-loss levels. Signals can be generated manually by experienced traders or through automated trading systems that analyze market data.

Types of Crypto Signals

Manual Signals: These are provided by experienced traders who analyze market conditions, charts, and developments in the crypto space. These signals often come with explanations, detailing the reasoning behind the recommended trade.

Automated Signals: Generated by algorithms or trading bots, these signals rely on real-time data analysis and can provide immediate recommendations based on market indicators and trends.

News-Based Signals: These signals are triggered by significant news events that impact the cryptocurrency market. For example, a partnership announcement or regulatory news could lead to price adjustments, prompting a trading signal.

Types of Crypto Signals

Pros & Cons (Quick Summary)

Where to Find Them in 2026

Crypto signals can be delivered through various channels:

Social Media: Many traders share signals through platforms like Twitter, Telegram, or Discord. These communities can provide a wealth of information and insights.

Websites and Blogs: Various crypto-focused platforms offer signal services, often with accompanying analysis and advice on market trends.

Trading Platforms: Some exchanges and trading platforms provide integrated signal services, allowing traders to receive alerts directly within their trading environments.

Choosing Reliable Signal Providers

The effectiveness of crypto signals largely depends on the reliability and credibility of the provider. Here are some guidelines to consider:

Reputation: Look for providers with positive reviews and a proven track record. User feedback can be invaluable in determining reliability.

Transparency: A good signal provider should be transparent about their strategies, including their win rates, risk levels, and past performance.

Educational Resources: Providers that offer educational resources can help traders understand the rationale behind the signals, improving overall trading skills.

Analyzing Signals

Once you receive a signal, it's essential to analyze it critically:

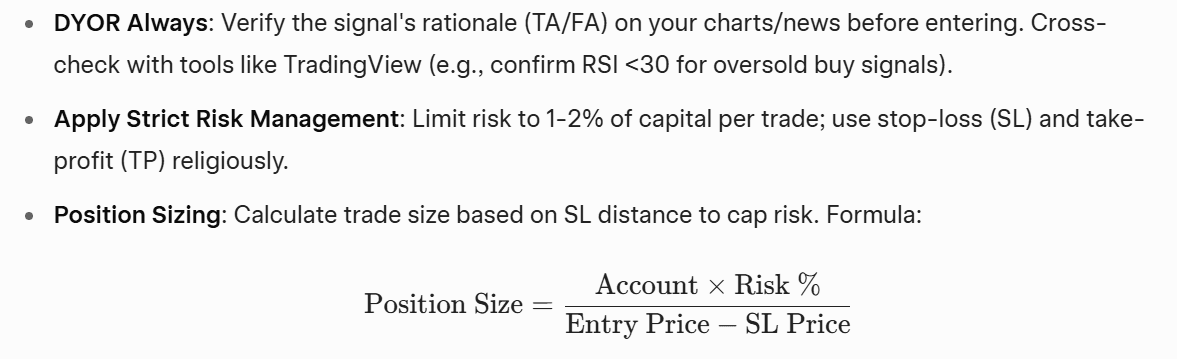

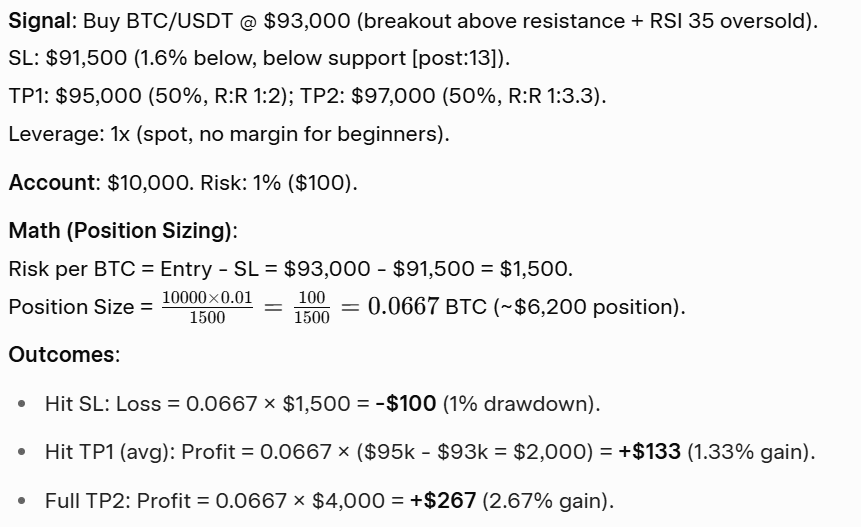

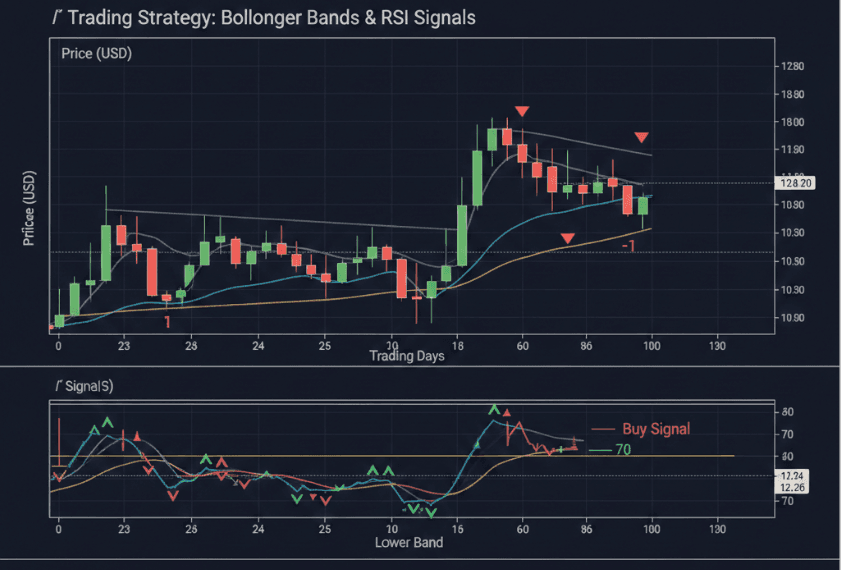

Confirm with Technical Analysis: Before acting on a signal, review the associated cryptocurrency's price chart. Look for support and resistance levels, trends, and any relevant indicators (like moving averages or RSI).

Consider the Market Context: Examine the broader market conditions. If the entire market is experiencing a downturn, a signal suggesting a buy may not be reliable.

Risk Assessment: Evaluate the risk associated with the trade. If the potential loss, represented by the stop-loss level, is too significant relative to potential gains, it may be wise to reconsider.

Effective risk management is crucial when using crypto signals. Here are some strategies for maintaining a balanced approach:

Keeping a Trading Journal

Maintaining a trading journal can enhance your trading discipline. Document trades based on the signals you act upon, noting the rationale behind each decision, the results, and any lessons learned. This practice can help you refine your strategy over time and identify areas for improvement.

Accessibility and Inclusiveness

One of the primary reasons for the popularity of crypto signals is their accessibility. Many signal providers offer free services, allowing individuals to enter the market without significant financial commitment. This democratizes access to trading tools and information, enabling a broader audience to participate in cryptocurrency trading.

Time-Saving Benefits

Crypto trading can be time-consuming, requiring continuous monitoring of market movements. By utilizing signals, traders can save time while still acquiring valuable insights. Signals allow even those with limited knowledge of technical analysis to make informed trading decisions based on expert recommendations.

Community and Collaboration

Many crypto signal groups foster a sense of community where traders can share insights, strategies, and experiences. This collaboration can enhance learning, providing individuals with support and guidance. Being part of a community can also make the trading experience more enjoyable, as traders engage with like-minded individuals.

Emotional Shield

Trading can invoke emotional responses, such as fear and greed, leading to impulsive decisions. Using crypto signals can create a disciplined trading framework based on structured analysis instead of emotional reactions. Following signals can help traders stick to their strategies, reducing the likelihood of emotional trading mistakes.

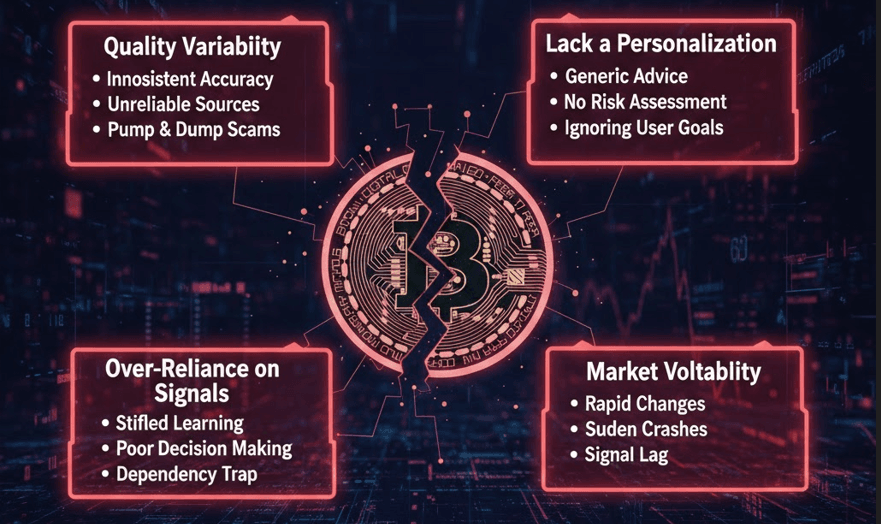

Quality Variability

While there are many reliable signal providers, the quality can vary significantly. Free signals may not always come with thorough analysis and could lead to poor trading decisions. It's essential to evaluate the provider's performance history and methodology before relying on their signals.

Lack of Personalization

Free crypto signals are typically generic and may not take individual risk tolerance or trading styles into account. Traders must adapt these signals to their personal strategies, which can lead to misalignment and potential losses.

Over-Reliance on Signals

Relying solely on crypto signals can inhibit a trader's learning curve. While signals can be beneficial, it's essential to develop personal trading skills and understanding. As traders grow more experienced, they should strive to reduce reliance on external signals and make independent decisions.

Market Volatility

The cryptocurrency market is highly volatile, meaning that even well-researched signals can lead to unexpected outcomes. Market conditions can change rapidly due to various factors, including news events, regulatory changes, and shifts in investor sentiment. Traders must remain aware of this volatility and use signals as part of a broader strategy.

Pair Signals with Research

While crypto signals provide valuable insights, coupling them with personal research can enhance decision-making. Familiarize yourself with the cryptocurrencies you are trading, keeping an eye on news, developments, and broader market trends. This holistic approach will help you make more informed decisions.

Stay Updated on Market Trends

Constantly monitor the cryptocurrency landscape, including macroeconomic factors and regulatory developments. Understanding the context surrounding market movements can improve the effectiveness of signals and enhance your trading strategies.

Regularly Review and Adapt Strategies

Trading is an evolving field, and strategies must be regularly reviewed and adapted to changing market conditions. Assess your trading results, evaluate signal performance, and modify your approach based on what works and what doesn’t.

Participate in Educational Opportunities

Engage with educational resources such as online courses, webinars, and workshops to learn more about trading, technical analysis, and market dynamics. The more knowledge you acquire, the better your ability to make informed trading decisions.

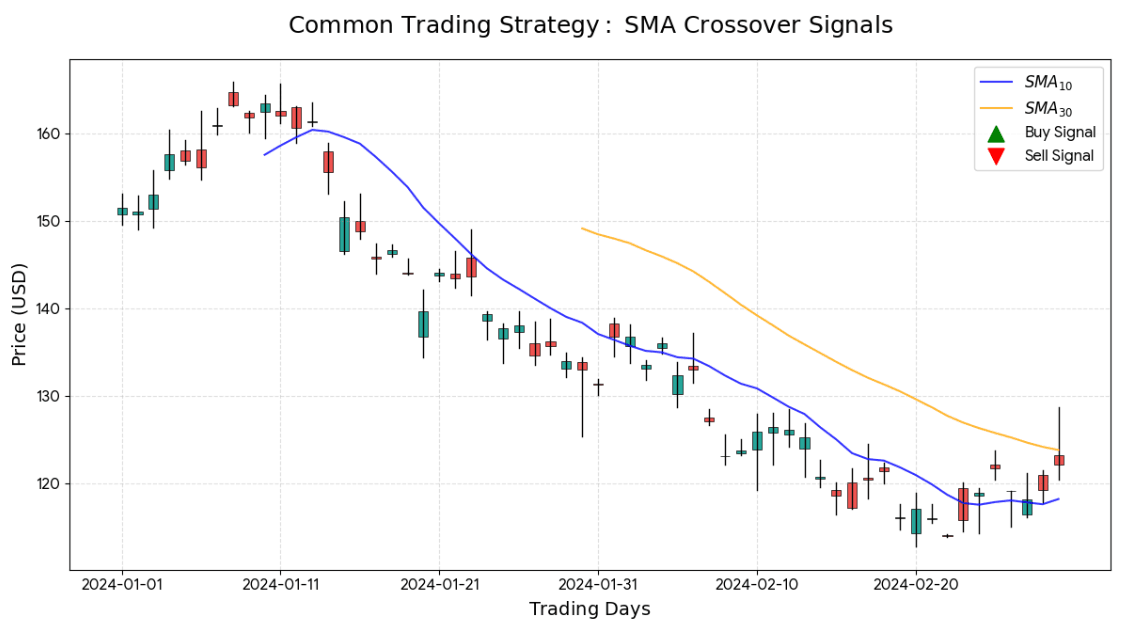

Common Trading Strategies Utilizing Signals

Swing Trading: This strategy involves holding positions for several days or weeks to capture significant price movements. Traders often use signals to identify optimal entry and exit points based on momentum and market trends.

Day Trading: Day traders often rely on short-term signals to make rapid trades within a single day. This strategy requires a keen understanding of price fluctuations and market conditions. Signals can help day traders identify opportunities more effectively.

Tools to Enhance Trading with Signals

Charting Software: Utilizing advanced charting software can complement signals by allowing traders to visualize trends, patterns, and market indicators effectively. This software can show real-time data, helping traders make better decisions.

Mobile Trading Apps: Many exchanges provide mobile trading apps that enable traders to act on signals immediately, regardless of their location. These tools help maintain flexibility in trading strategies.

Portfolio Management Tools: Keeping track of multiple positions across various cryptocurrencies can be challenging. Portfolio management tools help traders monitor performance, allocate resources effectively, and assess exposure to risk.

News Aggregators: Staying updated on the latest news is essential for making informed trading decisions. News aggregators gather information from various sources, enabling traders to assess potential impacts on their positions swiftly.

The Trader’s Mindset

The mindset of a trader can heavily influence their trading success. Here are key psychological aspects to consider:

Discipline: Successful traders maintain discipline in executing their strategies. They stick to their plans and remain committed to their principles, even in times of volatility.

Patience: The ability to wait for the right moment to enter or exit a trade is crucial. Patience can prevent traders from making impulsive decisions based solely on emotion.

Managing Emotions: Fear and greed can drive irrational decision-making. Recognizing these emotions and implementing strategies to manage them can enhance overall trading performance.

Developing Emotional Resilience

Building emotional resilience is essential for long-term success in trading. Here are some strategies:

Mindfulness Practices: Mindfulness techniques, such as meditation or deep-breathing exercises, can help traders maintain calm and focus, allowing for better decision-making.

Setting Realistic Goals: Establishing achievable trading goals can help manage expectations and reduce pressure. Focus on gradual progress rather than immediate returns.

Reviewing Performance: Regularly reviewing past trades can provide insights into emotional reactions during trading. Learning from previous mistakes can bolster a trader’s decision-making process.

Building a Support Network

Having a support network of fellow traders can provide valuable reassurance and guidance. Engaging in online communities or local trading groups fosters collaboration, allowing individuals to discuss strategies and share experiences.

Emerging Technologies in Crypto Trading

The cryptocurrency landscape is evolving, with emerging technologies influencing how traders operate:

Artificial Intelligence (AI): AI-driven trading algorithms are increasingly used to analyze vast amounts of market data in real-time. These systems can create more accurate signals based on extensive historical data and trends.

Machine Learning: Machine learning enables systems to analyze patterns and adapt to changing market conditions. As datasets grow, these algorithms can refine their predictions for better outcomes.

Blockchain Technology: Enhanced security and transparency features may lead to more reliable signal service providers. Blockchain technology can improve trust in data accuracy and provider integrity.

Regulatory Landscape

As the cryptocurrency market matures, regulators are increasingly scrutinizing the industry. Changes in regulatory frameworks can impact trading practices, including the use of signals. Traders must stay informed about regulatory developments and adapt their strategies accordingly.

The Growing Importance of Education

As cryptocurrencies mature, the emphasis on trader education will become paramount. More educational resources, platforms, and courses will likely emerge to support novice traders looking to enhance their skills and understanding of the market.

Overview of Markets.com

Markets.com is widely recognized as one of the leading brokers for trading Contracts for Difference (CFDs), particularly in the cryptocurrency sector. With its user-friendly platform and extensive range of assets, Markets.com caters to both novice and seasoned traders looking to capitalize on the volatility of digital currencies.

Comprehensive Asset Selection

One of the standout features of Markets.com is its diverse selection of cryptocurrencies available for CFD trading. Traders can access major coins such as Bitcoin, Ethereum, and Litecoin, alongside a variety of altcoins. This extensive array allows users to diversify their portfolios and take advantage of multiple market trends.

Advanced Trading Tools

Markets.com provides an array of advanced trading tools that enhance the trading experience. The platform offers real-time data, customizable charts, and technical analysis indicators, enabling traders to make informed decisions. Additionally, features like risk management tools and demo accounts allow users to practice strategies without financial risk.

Regulatory Compliance and Security

Safety and security are paramount at Markets.com. The broker operates under strict regulatory frameworks and is regulated by reputable authorities. This compliance ensures that the funds of clients are secure and that trading practices are transparent and fair.

Responsive Customer Support

Markets.com prides itself on delivering excellent customer service. Traders have access to a knowledgeable support team that is available 24/7, ready to assist with any inquiries or issues. This level of support adds an extra layer of confidence for traders navigating the complexities of crypto CFD trading.

With its robust features, extensive asset selection, and commitment to security, Markets.com stands out as one of the best brokers for crypto CFD trading. Whether you are a beginner or an experienced trader, Markets.com offers the tools and support necessary to succeed in the dynamic cryptocurrency market.

Crypto signals have gained popularity as a valuable tool for traders navigating the complexities of the cryptocurrency market. Their accessibility, time-saving benefits, and the sense of community they foster make them attractive to both novice and experienced traders alike.

While the allure of quick gains is strong, successful trading requires diligence, research, and risk management. By understanding how to use signals effectively, traders can enhance their trading experience while working toward their educational goals.

Moreover, as the industry continues to evolve, the integration of emerging technologies and a greater emphasis on education will reshape the trading landscape. This dynamic environment presents both challenges and opportunities for those willing to adapt.

By embracing continuous learning and leveraging tools such as crypto signals, traders can position themselves for success in the fluctuating and exhilarating world of cryptocurrency trading. Whether you are just starting or already have experience, understanding the intricacies of trading and utilizing the right tools can lead to more informed decision-making and enhanced trading performance in this vibrant market.

Looking to trade crypto CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.