Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Monday Dec 8 2025 10:43

15 min

Crypto CFD trading: Cryptocurrency trading has taken the world by storm, offering traders unique opportunities to profit from the volatile nature of digital assets.

CFD trading guide: Among the various trading methods, Contracts for Difference (CFDs) have become increasingly popular. This article will explore what crypto CFDs are, how they work, the advantages and disadvantages of trading them, and a step-by-step guide to trading crypto CFDs with a well-known trading platform.

Definition of CFDs

Contracts for Difference (CFDs) are financial derivatives that allow traders to speculate on the price movements of an underlying asset without owning the asset itself. Instead of buying or selling the asset directly, traders enter into a contract that reflects the price fluctuations of the asset. This can include a wide range of financial instruments, including stocks, commodities, indices, and cryptocurrencies.

How CFDs Work

When a trader enters a CFD contract, they agree to exchange the difference in the asset’s price from the time the contract is opened to the time it is closed. If the trader believes the price of the asset will rise, they will take a "long" position. Conversely, if they expect the price to fall, they will take a "short" position. The profit or loss depends on the change in price between the opening and closing of the trade.

Basics of Crypto CFDs

Crypto CFDs facilitate trading cryptocurrencies without the need to own the actual digital coins. This means that traders don’t need a digital wallet or a thorough understanding of blockchain technology. Instead, they can leverage the price volatility of cryptocurrencies to potentially profit from market movements.

Opening a Position

When trading a crypto CFD, traders can use leverage to increase their exposure to the market. For example, if a trader has a margin requirement of 10%, they can control a position ten times larger than their initial investment. This means they only need to deposit a fraction of the total value of the trade as collateral.

Example Scenario

If Bitcoin is trading at a value of 50,000 and a trader wants to use a CFD to buy one BTC with a margin requirement of 10%, they would need to invest 5,000 as their initial margin to control the full value of the asset. If Bitcoin rises to 60,000, the trader can close the position, realizing a profit based on the difference minus any fees.

Closing a Position

To close a position, the trader will execute a sell order for a long position or a buy order for a short position. The difference between the opening price and closing price, multiplied by the number of contracts held, determines the profit or loss.

Advantages of Crypto CFDs

Leverage: CFDs often allow traders to leverage their investments, which means they can control larger positions with a smaller amount of capital. This potential for higher returns can be attractive.

Disadvantages of Crypto CFDs

Understanding Margin in CFD Trading

Margin refers to the collateral required to open and maintain a leveraged trading position. It is a crucial concept in CFD trading as it enables traders to control larger positions with a smaller amount of capital.

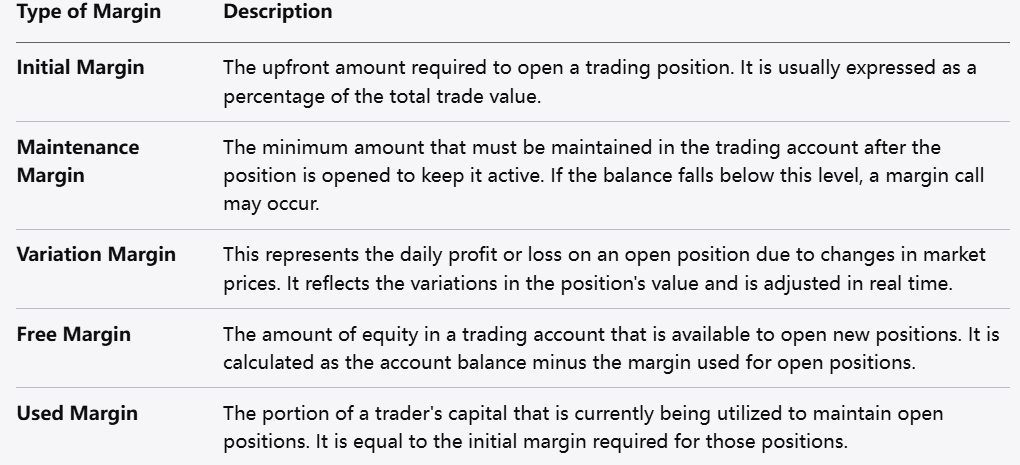

Types of Margin

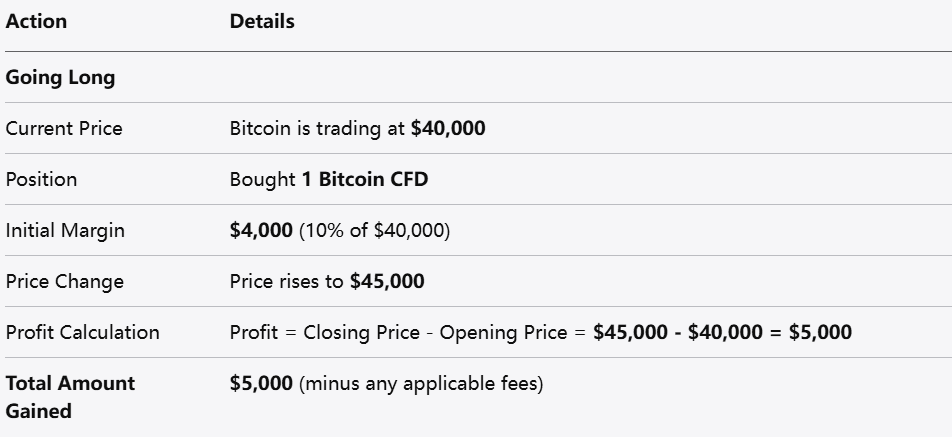

Going Long

Going long entails buying a CFD with the expectation that the price of the underlying cryptocurrency will rise. When traders go long, they anticipate making a profit when they close the position at a higher price.

Example of Going Long

A trader buys a CFD for Bitcoin at 50,000. If they close the position at 60,000, their profit would be the difference of 10,000, multiplied by the number of units traded, minus any fees.

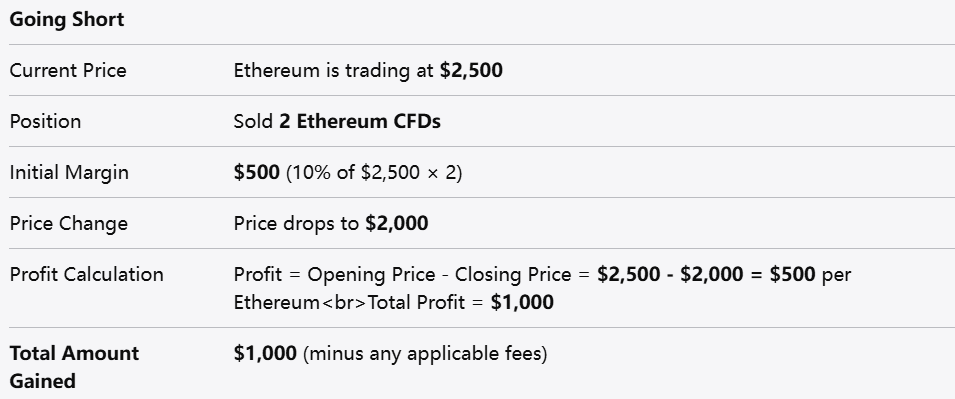

Going Short

Going short involves selling a CFD because the trader believes the price of the cryptocurrency will fall. This strategy allows the trader to profit from declining markets.

Example of Going Short

A trader sells a CFD for Bitcoin at 50,000, expecting the price to decrease. If the price drops to 40,000 and the trader closes the position, they would realize a profit of 10,000, minus any fees.

Flexibility

Trading crypto CFDs allows for significant flexibility. Traders can quickly enter or exit positions without the constraints of traditional investing in physical assets.

Risk Management

CFDs often provide tools like stop-loss and take-profit orders, enabling traders to manage risks effectively. These tools can automatically close positions at predetermined profit or loss levels, safeguarding capital.

Diversification

CFDs allow traders to diversify their portfolios efficiently by providing access to a range of cryptocurrencies and digital assets. This diversification can help mitigate risks associated with market fluctuations.

Short-Term Trading Opportunities

The volatile nature of cryptocurrencies can create numerous short-term trading opportunities. CFDs allow traders to capitalize on these fluctuations without needing to hold the underlying asset long-term.

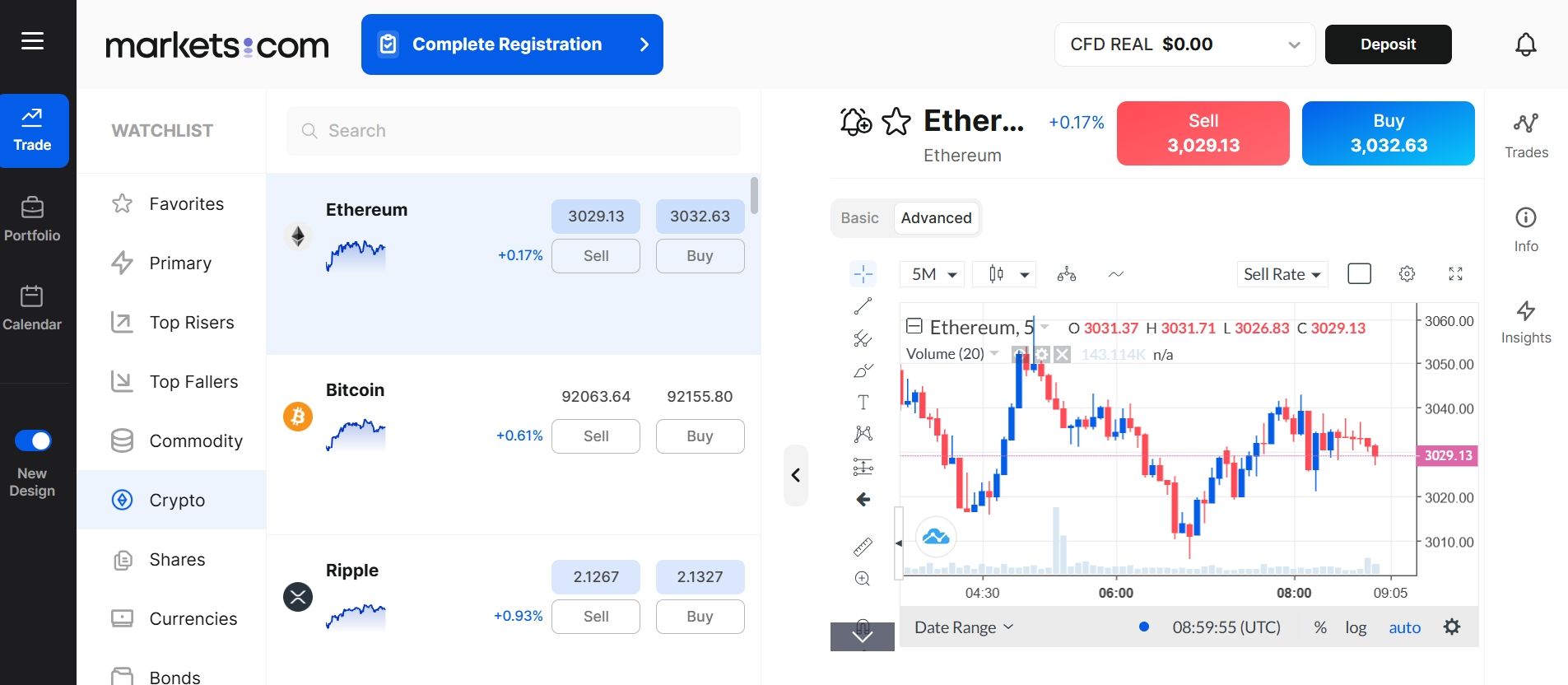

Step 1: Choose a Broker

Before trading crypto CFDs, select a reputable trading platform. For this guide, we will use Markets.com, a well-known platform that offers a range of cryptocurrencies for CFD trading. Ensure that the broker is regulated and provides a user-friendly interface.

Step 2: Open an Account

Creating an account with Markets.com typically involves providing personal information, including your name, email, and phone number. You may also need to provide identification documents to satisfy regulatory requirements.

Registration: Fill out the registration form on the Markets.com website.

Verification: Confirm your email address and complete the verification process as instructed.

Step 3: Fund Your Account

After your account is verified, you will need to deposit funds to start trading. Markets.com offers multiple funding options, including credit/debit cards, bank transfers, and e-wallets. Ensure to check if there are any minimum deposit requirements.

Step 4: Explore the Trading Platform

Familiarize yourself with the Markets.com trading platform. Take time to explore the various features, including:

Charting Tools: Use technical analysis tools to analyze price movements.

Market News: Stay updated with the latest news related to cryptocurrencies, as it can impact market conditions.

Risk Management Tools: Learn how to use stop-loss and take-profit orders effectively.

Step 5: Choose Your Cryptocurrency

Select the cryptocurrency CFD you wish to trade from the available options on the platform. Markets.com typically offers a range of popular cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin.

Step 6: Analyze the Market

Conduct thorough market analysis before executing a trade. Utilize technical analysis tools, charts, and fundamental analysis to evaluate price trends and potential market movements.

Step 7: Open a Position

Decide whether you want to go long or short based on your market analysis:

Long Position: If you believe the price will rise, select the "Buy" option to open a long position.

Short Position: If you believe the price will fall, select the "Sell" option to open a short position.

Step 8: Set Your Margin and Leverage

When opening a position, specify the amount of leverage you wish to use. Markets.com allows traders to set leverage, but it’s crucial to understand the implications of using high leverage and how it affects risk.

Step 9: Implement Risk Management

Before confirming the trade, consider setting stop-loss and take-profit levels. This helps protect your investment and locks in profits when the market moves in your favor.

Step 10: Monitor Your Position

After executing the trade, keep an eye on the position. Use the platform’s monitoring tools to track price movements and market conditions.

Step 11: Close Your Position

When you are satisfied with the performance of your trade or if it hits your stop-loss or take-profit limits, close your position. This will finalize your profit or loss based on the price change from when you opened the position.

Step 12: Withdraw Your Profits

If you’ve made a profit from your trades, you can withdraw your funds through the same method used for deposits. Ensure you understand any withdrawal fees or processing times associated with your chosen method.

Trading cryptocurrency CFDs offers traders unique opportunities to profit from the volatility of digital assets without owning the underlying cryptocurrencies. With leverage, the ability to go long or short, and access to various cryptocurrencies, CFDs have much appeal for both new and experienced traders. However, cryptocurrency CFD trading carries its own set of risks, including market volatility and the potential to amplify losses through leverage.

By following the guidelines and steps outlined in this article, traders can navigate the complex world of crypto CFDs, making informed decisions and enhancing their trading skills. Whether you are a seasoned trader or just starting, understanding the essential concepts of crypto CFD trading is vital for success in this fast-paced market. Always remember to conduct thorough research and consider managing risk appropriately to get the most out of your trading experience.

Looking to trade crypto CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.