Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Friday Nov 14 2025 07:32

15 min

Commodity trading strategy: West Texas Intermediate (WTI) crude oil has long been a central commodity in global energy markets.

WTI crude oil price today: As a benchmark for oil prices in the United States, WTI plays a critical role in shaping trading strategies and influencing economic sectors worldwide. However, recent market signals suggest WTI could face downward pressure, raising questions about the implications for traders and the broader commodity landscape.

This article explores the potential decline in WTI crude oil prices, evaluates the factors driving this trend, and offers strategic insights for commodity traders aiming to navigate the evolving energy market.

What is WTI Oil?

WTI is a high-quality light sweet crude oil that serves as a key benchmark in the global oil market. It is primarily sourced from U.S. oil fields and stands out due to its low sulfur content, making it easier and less costly to refine into gasoline and other products.

Importance of WTI in Commodity Markets

WTI oil prices are closely watched by traders, companies, and governments because of their impact on production costs, consumer fuel prices, and economic health. Its price movements often reflect supply-demand dynamics, geopolitical developments, and broader macroeconomic trends.

Supply and Demand Imbalances

One of the primary drivers behind the possible decline in WTI prices is the evolving balance between supply and demand. Several factors contribute to this imbalance:

Geopolitical Developments

Global political events significantly influence oil markets. Recently, easing tensions in key oil-producing regions or agreements to increase output may contribute to an oversupply scenario.

Conversely, instability or conflict could tighten markets, but current trends point toward relative stability or increased supply commitments, affecting WTI negatively.

Macroeconomic Factors

Broader economic indicators such as global economic growth rates, trade dynamics, and currency fluctuations also impact oil prices. Signs of economic deceleration or trade disruptions can reduce demand expectations for oil.

Additionally, movements in the U.S. dollar—often inversely correlated with commodity prices—can affect WTI valuation.

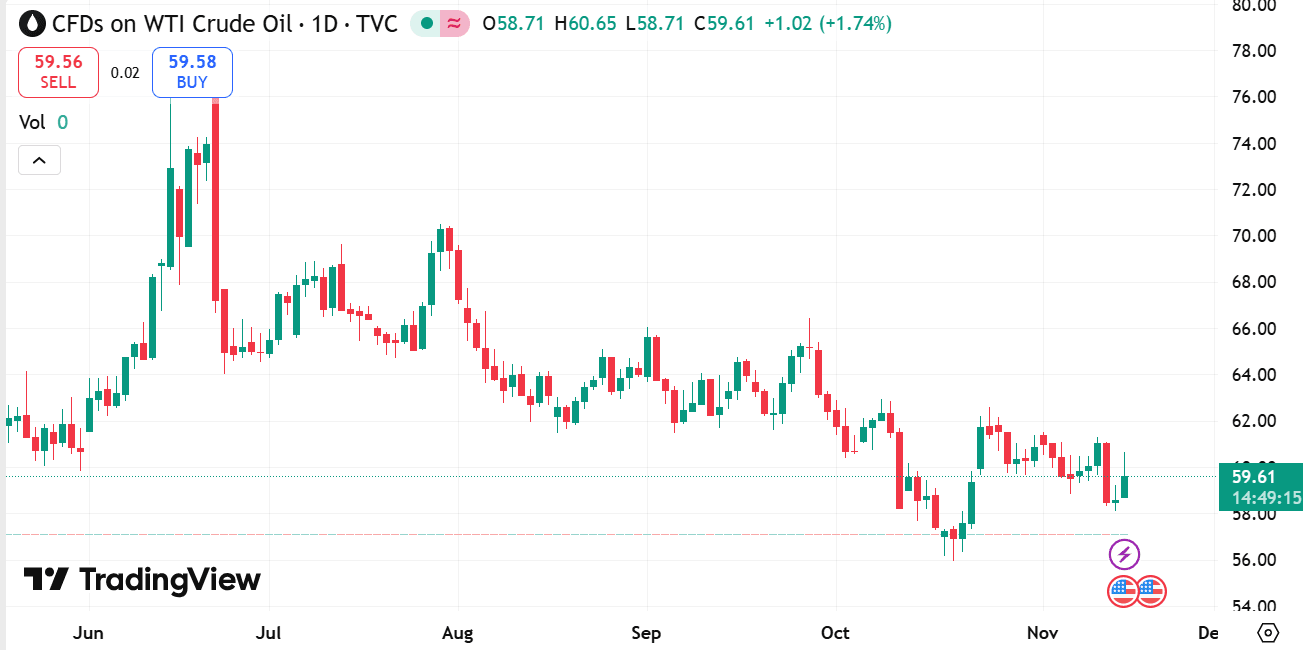

source: tradingview

Market Sentiment and Speculation

Trading volumes and sentiment indicators reveal the collective mood of market participants. Growing bearish sentiment or increased speculative short positions often precede price declines.

Technical Patterns

While not relying on specific price points, traders observe patterns such as resistance levels, moving averages, and momentum shifts that may signal weakening trends in WTI.

Navigating a declining WTI oil environment requires thoughtful adjustments to trading strategies. Below are several considerations and approaches traders can adopt.

1. Risk Management and Position Sizing

Importance of Risk Controls

In a market facing downward price pressure, managing risk exposure is paramount. Traders should reassess position sizes, ensuring they align with updated risk tolerance levels.

Use of Stop-Loss Orders

Implementing well-placed stop-loss orders can protect capital from adverse movements, limiting potential losses if the decline accelerates.

2. Short Selling and Hedging Strategies

Short Selling WTI

For traders who anticipate further declines, short selling WTI futures or oil-related ETFs can provide opportunities to benefit from falling prices.

Hedging Physical Exposure

Producers or entities with physical oil exposure may use futures contracts or options to hedge against price declines, stabilizing revenue and cash flow.

3. Diversification into Related Commodities and Instruments

Exploring Alternative Energy Commodities

As oil faces uncertainty, diversification into commodities such as natural gas, coal, or renewable energy credits can provide portfolio balance.

Investing in Oil Services and Equipment Stocks

While oil prices may decline, some oilfield services or equipment companies might offer value depending on caps on production or infrastructure investments.

4. Monitoring Supply Chain and Inventory Signals

Tracking Inventory Data

Regularly reviewing inventory reports from agencies and private sources helps gauge the supply-demand balance and anticipate price movements.

Watching Production Adjustments

Announcements from oil-producing countries or companies about output cuts or increases can influence market direction.

5. Considering Macro and Policy Developments

Energy Policy Shifts

Government policies regarding energy independence, carbon emissions, or subsidies for renewables affect oil demand projections.

International Agreements

OPEC decisions and international agreements on production quotas are critical for understanding supply-side dynamics.

6. Utilizing Options for Flexibility

Call and Put Options

Options strategies can provide traders with more flexible risk profiles, allowing them to profit from volatility or protect existing positions.

Spreads and Combinations

Using spreads or combinations of options can reduce risk and capitalize on anticipated price ranges or timing.

7. Staying Alert to Market Volatility and News Flow

Volatility as an Opportunity

Periods of volatility often create trading opportunities through price swings. Active traders can use volatility-based strategies to capitalize on short-term movements.

Real-Time News Monitoring

Staying informed about geopolitical developments, economic data releases, and OPEC meetings enables timely reactions.

Early 2010s Price Crash

Examining past episodes of WTI price declines provides insights into how markets adjusted, including production cuts, demand rebounds, and policy responses.

Pandemic-Driven Price Collapse

The recent global health crisis demonstrated extreme volatility and rapid market adjustments, underscoring the importance of agility in trading strategies.

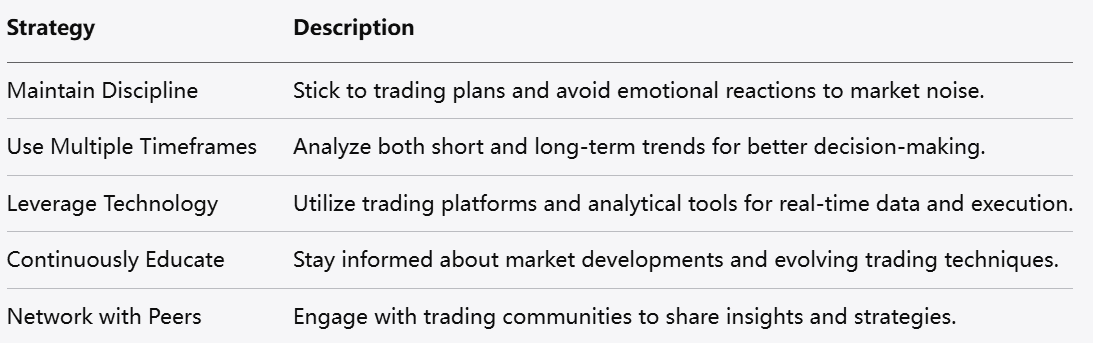

Maintain Discipline: Stick to trading plans and avoid emotional reactions to market noise.

Use Multiple Timeframes: Analyze both short and long-term trends for better decision-making.

Leverage Technology: Utilize trading platforms and analytical tools for real-time data and execution.

Continuously Educate: Stay informed about market developments and evolving trading techniques.

Network with Peers: Engage with trading communities to share insights and strategies.

WTI crude oil is facing a challenging market environment characterized by oversupply risks, shifting demand, and broader economic uncertainties. For commodity traders, adapting strategies to these conditions is essential.

A well-rounded approach includes strong risk management, diversification, active monitoring of market signals, and flexibility in trading tactics. By understanding the fundamental drivers behind the potential decline and preparing accordingly, traders can navigate the evolving energy landscape with greater confidence.

While challenges exist, volatility and shifting market dynamics also create pathways for strategic engagement and potential gains within the commodity space.

1. Why is WTI oil facing a potential decline?

WTI crude oil may face downward pressure due to multiple factors such as increased global supply, slowing demand growth, elevated inventory levels, geopolitical developments that ease tensions or increase production, and broader macroeconomic challenges like economic slowdowns or currency fluctuations. Together, these elements can create an oversupply situation or reduce demand expectations, leading to price declines.

2. How does an oversupply impact WTI prices?

When oil supply exceeds demand, inventories accumulate, signaling that the market is saturated. This surplus puts downward pressure on prices as sellers compete to offload excess barrels. Producers may need to lower prices to maintain sales volumes, which can trigger a broader price decline.

3. What role do geopolitical events play in WTI price movements?

Geopolitical stability or instability in key oil-producing regions greatly affects WTI prices. Conflict or sanctions can restrict supply, potentially pushing prices higher. Conversely, peaceful resolutions, increased production agreements, or lifting of sanctions can increase supply, contributing to price declines.

4. How can traders protect themselves against a decline in WTI oil prices?

Traders can use several risk management tools such as stop-loss orders to limit losses, diversify their portfolios to reduce exposure to oil-specific risks, and employ hedging strategies using futures contracts or options to offset potential losses. Short selling or purchasing put options are common methods to benefit from or protect against falling prices.

5. Is short selling a safe strategy when expecting WTI prices to fall?

Short selling can be profitable if WTI prices decline as anticipated, but it carries higher risk because losses can be unlimited if prices move against the position. Proper risk controls, position sizing, and stop-loss orders are essential to mitigate potential losses when short selling.

6. Should long-term investors avoid WTI oil during a decline?

Long-term investors may choose to maintain exposure if they believe in a future recovery or growth in oil demand. However, they should consider diversification and be prepared for volatility. Strategic allocation and periodic portfolio reviews help balance risks during periods of price weakness.

7. How do changes in U.S. dollar value affect WTI oil?

WTI oil prices are generally inversely related to the U.S. dollar. When the dollar strengthens, oil becomes more expensive for holders of other currencies, which can reduce demand and put downward pressure on prices. Conversely, a weaker dollar typically supports higher oil prices.

8. What are some alternative commodities to consider if WTI is declining?

Traders may look at natural gas, coal, or metals like copper and gold to diversify exposure. Renewable energy commodities or related financial instruments may also provide alternative opportunities as the energy landscape shifts.

9. How important is monitoring inventory reports for trading WTI?

Inventory levels provide critical insight into supply-demand balance. Rising inventories signal oversupply, potentially forecasting price declines. Conversely, falling inventories suggest tighter markets that could support prices. Regularly tracking these reports helps traders anticipate market trends.

10. Can options strategies be effective in a declining WTI market?

Yes. Options provide flexibility, allowing traders to hedge existing positions or speculate with limited risk. Put options can protect against price drops, while strategies involving spreads can reduce costs and manage risk exposure effectively.

11. What long-term trends could influence WTI oil prices beyond immediate supply and demand?

Structural changes such as the global shift toward renewable energy, technological improvements in energy efficiency, and evolving regulatory frameworks around carbon emissions will influence oil demand and supply dynamics. These trends may result in sustained pressure on oil prices or create new market opportunities.

12. How should traders respond to increased market volatility in WTI?

Volatility presents both risks and opportunities. Traders should use proper risk management tools and consider strategies designed for volatile markets, such as straddles or strangles in options trading. Maintaining discipline and avoiding emotional decision-making during volatile periods is crucial.

13. What is the role of OPEC in influencing WTI prices?

Though OPEC primarily influences global crude benchmarks like Brent, their production decisions impact global supply and indirectly affect WTI prices. Coordination among OPEC members and with other producers can tighten or loosen supply, influencing price trends.

14. How does demand from emerging markets affect WTI oil?

Emerging markets are major drivers of global oil demand. Economic growth or slowdowns in these regions significantly impact global consumption patterns. Increased demand from these markets can support prices, while economic challenges may weaken demand and contribute to price declines.

15. What resources can traders use to stay updated on WTI market developments?

Traders should follow reports from government agencies, industry groups, and international organizations, as well as news on geopolitical events and economic indicators. Real-time market data platforms, newsletters, and expert commentary can also provide valuable insights.

Looking to trade commodity CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.