Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Tuesday Feb 3 2026 08:59

26 min

CFD Trading for Beginners: Contracts for Difference (CFDs) have surged in popularity among retail and institutional traders alike.

This guide will unfold the essentials of CFD trading, explaining what it is, how it works, and the impact of leverage. We’ll also explore online CFD markets, review some of the best brokers available in 2026, and cover effective trading strategies for both new and seasoned traders.

CFD trading involves a financial derivative that allows traders to speculate on the price movements of various assets without actually owning the underlying asset. This can include stocks, commodities, cryptocurrencies, indices, and forex. The primary appeal of CFD trading lies in its flexibility and accessibility, enabling traders to engage with a wide range of markets.

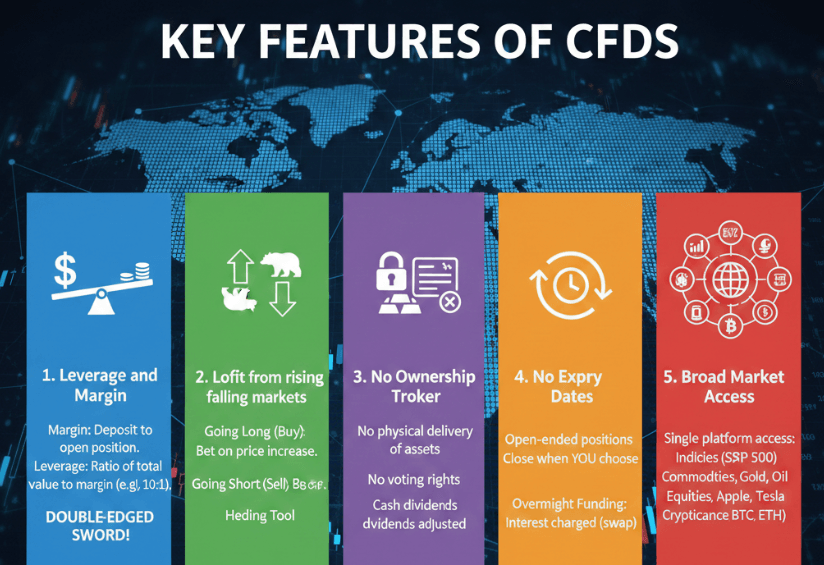

Here are the key features of CFDs, based on how they function in most regulated markets:

• No ownership of the underlying asset You do not own, receive dividends (in the case of stocks), or have voting rights associated with the asset (e.g., shares, commodities, indices, forex, or cryptocurrencies). You only gain exposure to its price changes.

• Profit from both rising and falling markets Traders can go long (buy) if they expect the price to rise or short (sell) if they expect it to fall, with no restrictions on short-selling like in some traditional markets.

• Leverage (margin trading) CFDs are leveraged products, meaning you only need to deposit a fraction (margin) of the full position value to open a trade. This amplifies both potential profits and losses (e.g., 10:1 leverage means controlling $10,000 worth of assets with $1,000).

• Wide range of underlying markets CFDs provide access to diverse assets, including stocks, stock indices, forex pairs, commodities (oil, gold, etc.), cryptocurrencies, bonds, and more—often with global market coverage in one platform.

• No fixed expiration date Unlike futures or options, most CFDs have no set expiry (they remain open until you close the position, a stop-loss/take-profit triggers, or a margin call occurs), offering greater flexibility.

• Contract settlement in cash Profits or losses are calculated purely as the price difference (multiplied by contract size) and settled in cash—no physical delivery of the asset occurs.

• Costs and fees involved Trading typically involves spreads (difference between buy and sell prices), commissions (on some brokers), and overnight/swap fees for holding positions past market close. These can reduce net returns.

• High risk profile Due to leverage, losses can exceed your initial deposit (though many brokers offer negative balance protection in regulated jurisdictions). CFDs are complex and often result in losses for retail traders.

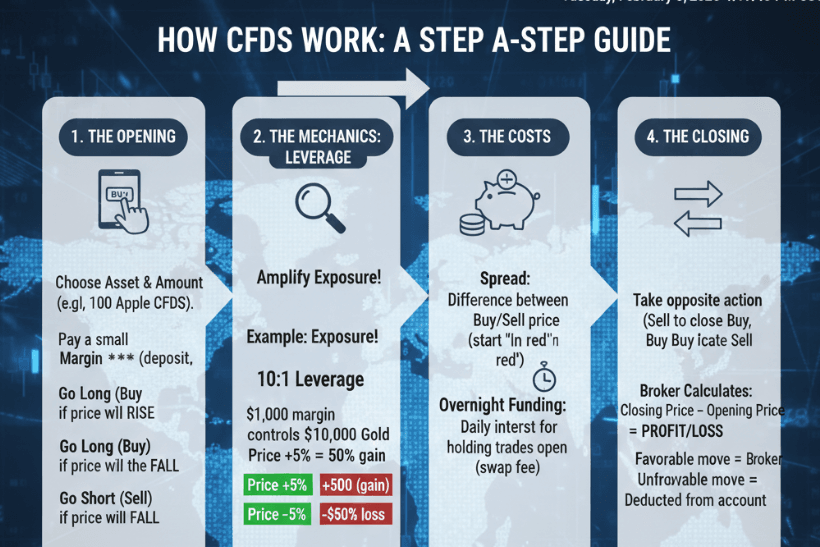

CFDs operate based on the difference between the opening and closing prices of a trade. When a trader opens a position, they agree to pay the difference between the opening price and the closing price, and this amount reflects either a profit or a loss.

Opening a CFD Trade

Choosing an Asset: Traders select an asset to trade, which could be anything from shares to cryptocurrencies.

Specifying Position Size: Traders decide on the position size, expressed in lots. One lot typically represents a specific amount of the underlying asset.

Setting Leverage: Traders usually have the option to apply leverage, allowing them to control a more significant position with a smaller amount of capital.

Executing the Trade: Once the specifics are set, the trade is executed. The trader’s profit or loss is determined by the difference in price when the position is closed.

Closing a CFD Trade

To realize profits or losses, a trader must close the trade. At this point, the broker calculates the difference between the opening and closing prices, factoring in any applicable fees or commissions.

Profit Scenario: If the closing price is higher than the entry price (for a long position), the trader makes a profit.

Loss Scenario: Conversely, if the closing price is lower, the trade incurs a loss.

Example: Long Position on Apple (AAPL) Stock CFD

Assume you're trading with a broker offering stock CFDs (common in regions like Europe, Australia, or the UK). Leverage is typically 5:1 for major stocks (20% margin requirement), but the P&L calculation uses the full exposure.

Asset: Apple Inc. (AAPL) CFD

Opening the trade (long/buy): You expect the price to rise.

Entry price: $220.00 per share

Number of CFDs: 100 (each CFD represents 1 share)

Full position value: 100 × $220 = $22,000

Margin required (20%): $4,400 (your deposited funds to open/control the position)

You buy 100 AAPL CFDs at $220.00.

• Closing the trade: After a few days, the price moves.

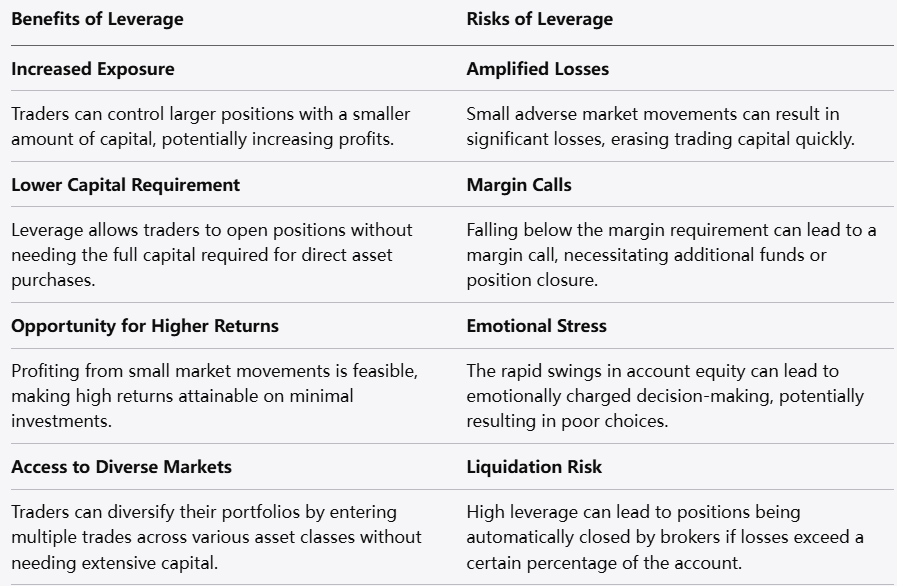

Leverage is one of the defining features of CFD trading, allowing traders to gain exposure to larger positions with a relatively small amount of capital. However, it comes with both benefits and risks.

Understanding Leverage

Leverage is expressed as a ratio (e.g., 1:100), meaning for every dollar in a trader’s account, they can control 100 dollars' worth of assets. This boosts potential returns, enabling traders to profit from even small market movements.

Benefits of Leverage

Increased Exposure: Traders can control larger positions, amplifying potential profits.

Lower Capital Requirement: With leverage, traders do not need to invest the full amount of capital required to purchase assets outright.

Opportunities in Volatile Markets: Leverage can maximize profits during periods of high volatility, allowing traders to capitalize on short-term movements.

Risks of Leverage

Amplified Losses: Just as leverage can increase profits, it can equally amplify losses, leading to significant financial risks. A small adverse move in the market can erase a trader's capital.

Margin Requirements: When using leverage, traders must maintain a minimum account balance, known as margin. If the account balance falls below this level, the broker may issue a margin call, requiring the trader to deposit more funds or close positions.

Emotional Stress: The potential for rapid gains and losses can lead to emotional trading decisions, which can compound risks.

Contracts for Difference (CFDs) offer a versatile way for traders to engage with various asset classes, enabling them to speculate on price movements without actually owning the underlying assets. Here are some of the most common asset classes available for CFD trading:

1. Indices

Trading indices allows investors to speculate on the performance of entire stock markets. An index represents a collection of stocks, generally covering a specific sector or region. Popular indices include:

S&P 500: Comprising 500 of the largest companies in the U.S., this index is a barometer for the U.S. economy.

FTSE 100: This British index tracks the 100 largest companies listed on the London Stock Exchange, providing insight into the UK market.

DAX 40: The DAX represents 40 of the largest German companies traded on the Frankfurt Stock Exchange, making it a key indicator of the German economy.

Indices trading typically involves lower fees compared to trading individual stocks, and it can provide broader market exposure, reducing specific stock risk.

2. Forex

The forex market is the largest financial market globally, and CFD trading allows for speculation on currency pairs. Traders can bet on the rise or fall of exchange rates between two currencies. Commonly traded pairs include:

EUR/USD: This pair represents the Euro against the U.S. Dollar and is one of the most actively traded in the world.

GBP/JPY: This pair indicates the exchange rate between the British Pound and the Japanese Yen, often favored for its volatility.

Forex CFDs enable traders to profit from both upward and downward price movements, providing flexibility regardless of market conditions.

3. Shares

CFD trading allows you to speculate on the price movements of thousands of shares from global companies without the traditional brokerage fees associated with buying and selling stocks. This means you can trade high-profile companies like:

Apple Inc.

Tesla, Inc.

Amazon.com, Inc.

CFDs on shares typically include the same potential for leverage as trading other asset classes, making it possible to amplify returns. Moreover, traders can take advantage of company earnings reports, analyst upgrades, and other market dynamics that influence share prices.

4. Commodities

CFDs provide exposure to both "hard" and "soft" commodities.

Hard commodities include tangible assets such as gold, silver, and oil. For example, gold is often viewed as a safe haven investment during economic uncertainty, while oil prices are influenced by geopolitical events and supply concerns.

Soft commodities encompass agricultural products like coffee, sugar, and wheat. Trading these commodities can be affected by environmental factors, seasonal changes, and global demand.

Investing in commodities through CFDs offers a way to diversify portfolios, particularly during periods of market volatility.

5. ETFs

Exchange-Traded Funds (ETFs) allow traders to engage with baskets of assets categorized by sector, geographical region, or investment theme. With ETFs, investors can gain exposure to multiple asset classes, such as:

Technology sectors

Renewable energy

Emerging markets

Trading ETFs as CFDs can be advantageous because it combines the diversification benefits of traditional ETFs with the flexibility of leveraging and short-selling. This makes ETFs an attractive option for both long-term and short-term traders seeking to capitalize on market trends.

6. Cryptocurrencies

Cryptocurrencies have emerged as a popular asset class for CFD trading, reflecting the growing interest and adoption of digital currencies. Trading cryptocurrencies allows investors to speculate on the price movements of various coins without needing to hold the actual currencies. Popular cryptocurrencies available for CFD trading include:

Bitcoin (BTC): As the first and most recognized cryptocurrency, Bitcoin usually leads the market and is often seen as a store of value.

Ethereum (ETH): Known for its smart contract functionality, Ethereum has seen significant growth and innovation, making it a popular trading option.

Ripple (XRP): This cryptocurrency is designed to facilitate cross-border transactions and has garnered attention for its potential utility in the financial sector.

When selecting a CFD broker, consider the following factors:

Regulation and Trustworthiness: Ensure the broker is regulated by a recognized authority, such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC).

Trading Costs: Look into spreads, commissions, and any overnight financing fees, which can erode profits.

Platform Usability: The trading platform should be user-friendly and equipped with the tools you need for effective trading, such as technical analysis features and charting tools.

Customer Support: Efficient customer service can be invaluable, especially for new traders who may have questions or require assistance.

Research and Analysis Tools

Successful CFD trading requires robust research and analysis. Many brokers provide tools like:

Market Analysis: Access to in-depth research, economic calendars, and market news.

Technical Analysis Tools: Charting capabilities and indicators that help traders analyze pricing trends.

Mobile Trading Apps: Many platforms offer mobile apps, allowing traders to manage their accounts on the go.

Risk Management

Effective risk management is critical in CFD trading. Consider employing strategies such as:

Stop-Loss Orders: Automatically close losing trades at predetermined levels to minimize losses.

Position Sizing: Carefully determine the size of each trade based on capital to manage risk effectively.

Diversification: Don’t put all your capital in one trade or asset class; diversifying can help spread risk.

As of 2026, several brokers have distinguished themselves in the CFD space. Below is an overview of some of the best CFD brokers to consider.

1. Pepperstone

Overview

Pepperstone is known for its low spreads and transparent pricing. Established in 2010, the broker has gained popularity among forex and CFD traders. It offers various asset classes, including forex, commodities, indices, and cryptocurrencies.

Pros

Competitive spreads

Multiple trading platforms

Excellent customer support

Cons

Limited product range compared to some competitors

Not available in certain countries

2. Markets.com

Overview

Markets.com is a leading CFD broker offering a robust trading platform and a wide range of instruments. The platform is user-friendly and caters to both beginners and experienced traders.

Pros

Intuitive trading platform

Extensive educational resources

Wide range of tradable assets

3. IG

Overview

IG is one of the largest and most well-established brokers in the industry, offering CFDs on various asset classes. Founded in 1974, IG provides excellent resources and tools for traders.

Pros

Extensive educational material

Multiple trading platforms

High liquidity and competitive spreads

Cons

Complex fee structure

Limited availability in certain regions

4. Plus500

Overview

Plus500 is a user-friendly broker well-suited for beginners. The platform offers a wide range of CFDs across various markets, along with a simple mobile app.

Pros

Simple and intuitive interface

No commission on trades

Free demo account available

Cons

Limited educational resources

Fewer advanced tools for experienced traders

5. XTB

Overview

XTB is a global broker that offers trading in forex and CFDs across various assets. Known for its powerful trading platform, XTB provides tools for both technical and fundamental analysis.

Pros

User-friendly proprietary platform

Extensive educational resources

Good customer support

Cons

Higher spreads on some instruments

Limited availability of certain payment methods

Markets.com is recognized as one of the best CFD trading platforms, particularly for new traders. Here’s a closer look at what it offers:

User-Friendly Interface

Markets.com features an intuitive trading interface that simplifies the trading process. This design is beneficial for beginners who may feel overwhelmed by complex trading platforms.

Variety of Assets

The platform provides access to a wide range of markets, including:

Forex pairs

Indices

Commodities

Cryptocurrencies

Stocks from various markets

Education and Resources

Markets.com offers a wealth of educational resources designed to help traders understand the complexities of CFD trading. This includes webinars, articles, and video tutorials, catering to both beginners and experienced traders.

Customer Support

Responsive customer service is crucial for any trading platform. Markets.com offers support through various channels, including live chat, email, and phone, ensuring that traders can get assistance when needed.

Implementing effective trading strategies is crucial for success in CFD trading. Here are four strategies that can be employed by both short-term and long-term traders.

Day trading involves buying and selling assets within the same trading day. Traders close all positions before the market closes to avoid overnight risk.

Tips for Day Trading

Focus on liquid markets with high trading volumes.

Use technical analysis to inform decision-making.

Stay disciplined and stick to your trading plan to avoid emotional decisions.

Swing trading is a medium-term strategy where traders look to capitalize on price swings over several days to weeks. This approach is less time-intensive than day trading.

Tips for Swing Trading

Analyze market trends and indicators to identify potential entry and exit points.

Use stop-loss orders to manage risks effectively.

Be patient and allow trades to mature before closing them.

Position trading is a long-term strategy where traders hold positions for weeks, months, or even years, aiming to profit from significant price movements over time.

Tips for Position Trading

Perform thorough fundamental analysis to support your trading decisions.

Regularly monitor news and market developments that could impact your positions.

Be willing to withstand market fluctuations without panic-selling.

To navigate the more complex world of CFD trading, some traders may wish to explore advanced strategies that take into account market psychology, complex analysis, and multi-faceted risk management techniques.

1. Hedging

Hedging is a risk management strategy employed to offset potential losses in an investment. Traders use CFD positions to hedge other investments, securing their overall portfolio against adverse market movements.

How to Hedge with CFDs

Open a Short Position: If you hold a long position in an asset, you can open a short CFD position on the same asset to protect against potential downturns.

Diversifying CFDs: Traders might simultaneously hold long and short positions across different assets or asset classes to mitigate risk.

2. Arbitrage

Arbitrage involves taking advantage of price discrepancies in different markets or instruments. Traders exploit these inefficiencies by buying low in one market and selling high in another, generating profits without exposure to market risk.

Execution of Arbitrage

Monitor price discrepancies between multiple markets for the same asset.

Execute trades quickly; since arbitrage opportunities can close within seconds, having fast execution and a reliable trading platform is essential.

3. News Trading

News trading relies on economic news and data releases to inform trading decisions. Market-moving news can lead to significant price volatility, providing opportunities for savvy traders.

Tips for News Trading

Use an economic calendar to track impending announcements that could impact your trading.

Be prepared for high volatility; set wider stop-loss orders during key news events to prevent premature exits from potentially profitable trades.

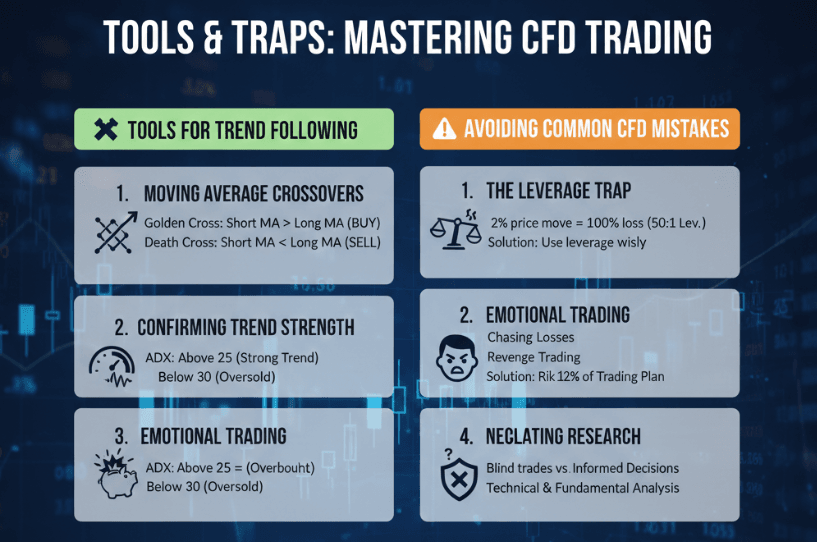

4. Trend Following

Trend following is a strategy that capitalizes on the momentum of price trends, allowing traders to ride along with prevailing market movements. In this strategy, traders aim to identify and follow the direction of trends rather than predicting reversals.

Moving Averages: Use short-term and long-term moving averages to identify current trends. A crossover between these averages can serve as a buy or sell signal.

Technical Indicators: Employ indicators such as the Average Directional Index (ADX) or Relative Strength Index (RSI) to confirm the strength of a trend.

Common Mistakes to Avoid in CFD Trading

Even with the best strategies, many traders make common mistakes that can hamper their success. Being aware of these pitfalls can help improve your trading performance.

1. Over-Leveraging

While leverage can enhance potential returns, using too much can lead to catastrophic losses. It’s essential to understand your risk tolerance and avoid maxing out leverage levels.

2. Neglecting Research

Traders often jump into trades based on tips or gut feelings rather than thorough analysis. Comprehensive research—both technical and fundamental—is crucial for making informed decisions.

3. Emotional Trading

Allowing emotions to dictate trading decisions can lead to irrational behavior. Developing a trading plan with clearly defined entry and exit criteria can help mitigate emotional decision-making.

4. Ignoring Risk Management

Failing to apply proper risk management techniques can expose you to significant losses. Always use stop-loss orders and ensure that your risk-to-reward ratio aligns with your trading strategy.

5. Chasing Losses

The desire to recover losses quickly can lead to aggressive and irrational trading behavior. Instead of chasing losses, take a step back, reassess, and stick to your trading plan.

CFD trading offers numerous opportunities for traders to capitalize on price movements across various markets. However, it comes with distinct risks, particularly related to leverage. Understanding how CFDs work, choosing the right broker, and developing robust trading strategies are critical components for success in this dynamic environment.

In this article, we’ve covered the fundamentals of CFD trading, the significance of leverage, and strategies ranging from basic to advanced techniques. Whether you are a novice trader looking to dip your toes into the world of CFDs or an experienced trader seeking to refine your strategies, this guide equips you with the essential knowledge needed to navigate the online CFD markets effectively.

With the right tools, information, and strategies, traders can enhance their chances of success in this exciting financial landscape. Remember to continuously educate yourself, adapt to changing market conditions, and practice disciplined trading to thrive in the world of CFD trading. The market is ever-evolving, and staying informed and agile is key to long-term success.

Looking to trade CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.